As real-estate developer Ian Rasch builds luxury downtown apartments and transforms an Egremont campground, how will his projects impact a region facing a housing crisis and continuing gentrification?

On an unusually cold morning in late summer, I stood outside 343 Main Street in downtown Great Barrington with Ian Rasch, the real-estate developer, and watched a stone mason he’s worked with for a decade—a Ukrainian immigrant, he tells me, who is 80 years old—use a small jackhammer to remove damaged bricks from the southern façade of the two-story, 22,000-square-foot building.

Designed as an early Ford Motors dealership by prolific Pittsfield architect Joseph McArthur Vance, Rasch bought the 100-year-old building last year from Berkshire Community College for $1.45 million. The mason’s slow, methodical work marked the latest phase in what the developer described as a multi-year effort to negotiate the purchase, acquire private-equity investors, secure bank financing, and organize the many moving parts of a $5.25 million downtown-redevelopment project.

In this case, he told me, that included a year and a half of environmental investigation to confirm that no toxins from the property next door—the site of a former variety store and gas station where a substantial amount of leaked petroleum was first discovered in 1986—had migrated to this one.

Entering Great Barrington’s downtown from the south, the striking white fencing encircling the project repeats the name of his company: Alander. It’s impossible to miss. And it serves as a prominent reminder to those concerned about the region’s housing struggle that the underutilized historic building—contrary to plans for a culinary school and wellness center Rasch put forward in a successful application for $250,000 in town historic-restoration funds—will soon become 13 large, high-end apartments.

They will feature 16-foot ceilings and upscale finishes, with eye-popping initial rents likely to range from $2,350 to $2,850 for one- and two-bedroom units, respectively, a few of which he told me he’s committed to reserving for income-limited tenants who will pay less.

Motioning to where a pile of shattered bricks was growing under the mason, Rasch described significant new landscaping and seating areas that will surround the building, reflecting his interest in design that incorporates nature into living spaces.

He said that when developing a residential project, he considers whether it’s a place his daughter—a seven-year-old who, naturally, still lives at home—could someday live. Constructing healthy, beautiful places for people to live, Rasch said, “is a responsibility. It’s a privilege.”

He pointed toward views of Searles Castle to the south and the green, rolling hills of East Mountain State Forest to the east. “I’d live here,” he said, smiling. “I mean, look around.”

As he begins work on three major—and immediately controversial—projects in the area, and with ambitious plans to redevelop a not-insignificant portion of downtown Great Barrington’s aging mixed-use commercial-and-residential buildings over the next decade, Rasch, a 45-year-old Egremont resident, seems preternaturally calm for someone diving into the roiling local waters of housing affordability, gentrification, and the economic future of this south-county hub. Indeed, in recent months his near silence about his plans has arguably stirred up those waters even more.

Despite growing up in the area and living here with his family since 2008, he is relatively unknown to the broader community. That limited public engagement has left many who live and work in the southern Berkshires—especially those struggling with rising housing costs—speculating about his motives, plans, and even whether he cares about those being priced out of the Berkshires. “He’s the guy who’s going to own Great Barrington,” volunteered a local real-estate agent, half-jokingly, when I mentioned plans to profile Rasch and his projects.

Others reasonably wonder if Rasch’s aggressive plans to invest heavily and redevelop downtown buildings into expensive rental apartments will accelerate Great Barrington’s decades-long transformation to ever-more-upscale shops and restaurants that primarily serve part-time residents, affluent retirees, and tourists. That evolution is pricing out resident workers and lower-income seniors and has contributed to the steady disappearance of amenities considered broadly affordable.

And while Great Barrington’s elected town boards continue to toss around ideas that might help address the crisis, assembling and sending each other lists of possible solutions to research but still lacking a discernable, clearly defined, multi-year action plan, it remains surprisingly unclear who’s driving the bus on housing—if anyone. It’s similarly mystifying why there has been little community organizing around the issue, except to venture that those who are comfortably housed have little appetite for the tax-raising and budget re-jiggering that may be necessary.

Select Board chair Steve Bannon brought this up at an early October meeting. He suggested that work on housing among various boards and committees may not be well organized or moving forward with the speed required. “What may be missing is a cohesive plan to do this. Everyone has good ideas, everyone’s willing to put in the work, but so far we’re working as separate groups,” Bannon told his colleagues. Selectman Ed Abrahams and vice chair Leigh Davis, who chairs a housing subcommittee that’s also gathering and prioritizing ideas, both raised similar concerns.

During our first conversation in early September, Rasch conceded that he’s not been as forthcoming about his projects, plans, and vision as he might have been. That includes how his work fits into the community discussion about the need for housing that full-time residents can afford.

“For the last 20 years, I’ve largely just done projects on the private side,” he explained as we sat outside a downtown café a few days before Labor Day. “I’ve had to engage the public in the way of permits and zoning and stuff like that, but not really too much more than that.”

Aside from a few public meetings connected to an unsuccessful effort to build 45 market-rate apartments at the end of Manville Street a few years ago, and a handful of promotional interviews about a redevelopment project he completed in 2018 on Railroad Street, he has largely stayed out of the public eye. He now thinks that was a mistake.

“I think I’ve failed, I’ve totally failed,” he told me. “It’s important that I engage and in some limited way expand the narrative to show what kind of complexities are related to these issues and what I’m thinking about for these projects.” He said that means not waiting until he’s in front of town boards asking for permits. “That’s the next step, engaging on a much higher level,” he said.

In fact, in advance of our first meeting, Rasch sent me a 12-page document with biographical information, his company’s priorities, and excerpts from articles that framed causes and proposed remedies to the national housing crisis. It described his thinking on a range of issues, from architecture to sustainable construction to walkable downtowns to modern zoning codes.

“At Alander, we are committed to creating more environmentally, socially, and economically resilient communities,” he wrote in the introduction. It also explained his interest in downtowns and village centers, which he highlighted as places “connected to the social fabric of a community where people know each other and check in on each other.”

It was the first of many encounters with Rasch that revealed him to be someone interested in both lofty ideas and practical action—as well as someone eager to shape a narrative.

No doubt his change-of-heart on public engagement is at least, in part, a savvy business move. In the absence of information, the initial public reaction to news of his plans to acquire the Mahaiwe Block—completed yesterday for a sale price of $3.5 million—and changes coming to the campground in Egremont has been fierce and largely negative. Yet it’s clear he brings to the table a holistic understanding of the enormous and widely misunderstood complexities of housing development and that he has long, useful experience in the type of historic restoration and construction that’s needed in a downtown packed with aging mixed-use buildings.

His acquisitions and redevelopment plans come as the region and nation face an increasingly entrenched housing crisis, with exploding, pandemic-fueled property values and climbing rents. In Great Barrington and the rest of south county, decades of underproduction of new multi-unit housing and a steady loss of housing inventory to part-time and seasonal use have left the resident workforce straining to find any house to buy or apartment to rent—much less one they can afford.

And the COVID-era shift to permanent remote work has further tightened the market and pushed up prices. Those earning metropolitan-area-sized salaries can now relocate to the Berkshires, willing and able to pay far more for housing while employed elsewhere.

The housing squeeze has affected people at all income levels but most dramatically those earning low and moderate wages. As a result, some have disappeared, leaving the area for more affordable housing further north in places like Pittsfield and Adams, or over the border in Connecticut and New York. Others move in with family, double up with friends, sleep on couches, and face increasing danger of becoming unhoused.

Indeed, at a recent Select Board meeting, Leigh Davis, the housing-focused vice chair who also works as director of development at housing-services nonprofit Construct, said her organization has started “giving out tents and sleeping bags” to families in crisis. Thanks to longstanding income and wealth inequality, and with darker economic clouds on the horizon, things may soon get worse.

As housing advocates have long warned, this has led to substantial staffing challenges for local businesses, from downtown restaurants to the region’s nonprofit sector to local health-care providers. Those who work here but can’t afford to live here are driving longer distances to their jobs, which is unsustainable with high gas prices and, as is the case with many service-sector jobs, often insufficient wages.

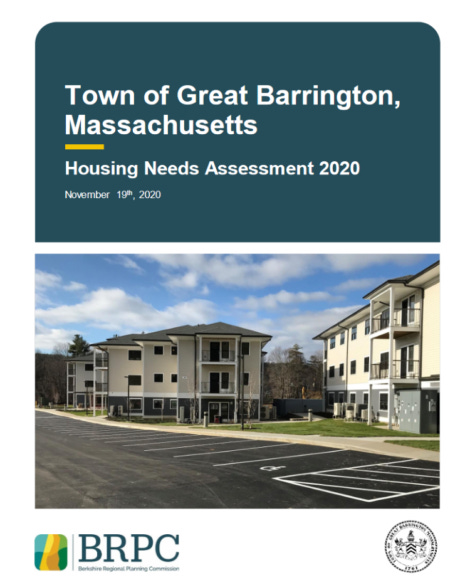

A housing-needs study completed for the town in 2020—using largely outdated data from the 2018 U.S. census and pre-pandemic information—found that a full 43 percent of Great Barrington renters were “cost-burdened,” or spending more than 30 percent of their income on housing expenses. This was before the pandemic housing rush pushed up home prices and rents. Pre-pandemic, 32 percent of homeowners were similarly cost-burdened. And across all of Berkshire County in 2018, about half of all renters were cost-burdened, according to the study. The needs assessment has not been updated with current data, but it’s widely understood that things are worse, not better.

Importantly, the study also showed an increase in resident incomes from 2010 to 2018 and a drop in cost-burdened renters from 59 percent in 2010 to that pre-pandemic 43 percent. What that suggests, though, is not exactly an economic and housing-affordability success story. Rather, it’s evidence that gentrification is steadily changing the make-up and demographics of the community.

Over those years, the local population became older, more affluent, and more able to afford expensive housing, while those less-well-off were pushed aside. And out. The median income level of full-time Great Barrington renters increased by a remarkable 54 percent during those eight years, suggesting increased rental costs affordable only by those with higher incomes. Home prices increased astronomically during the pandemic and put homeownership out of reach for many.

Today, a zero-vacancy rate for rentals has also left tenants more likely to keep quiet about substandard conditions for fear of losing their lease or simply because they have no other housing options. (Great Barrington does not have a rental registration or pre-inspection program to ensure safe, healthy living conditions. The town’s health agent, Rebecca Jurczyk, can only respond to complaints.)

While reporting this story, I also heard credible reports of residents taking out sizeable personal loans from local banks so they can offer a property owner six month’s rent in advance, hoping to nudge aside other applicants in this “supply-constrained market,” to use a term Rasch includes in his pitch to investors.

Great Barrington has directed substantial funds to address the impact of the housing squeeze from its one-time allocation of more than $2 million in federal American Rescue Plan Act (ARPA) monies. Though again, not in support of a clear set of policies, plans, or specific long-term goals articulated by the Select Board.

To distribute the $850,000 earmarked for housing, the town recently accepted applications from local nonprofits that will provide housing-related services like rent and mortgage assistance, food, health care, transportation, and job training—all needed and urgent but perhaps only treating symptoms and not the underlying cause. Town Manager Mark Pruhenski will next month make recommendations to the Selectboard for those grant awards.

There is some new affordable housing in the works. The Community Development Corporation of the Southern Berkshires’ (CDCSB) Windrush Commons on South Main Street will soon offer 49 one-, two-, and three-bedroom apartments for those earning less than 60 percent of area median income (AMI). That means income caps at Windrush of $39,540 for an individual and $56,460 for a family of four, according to Eileen Peltier, executive director of Berkshire Housing, which will coordinate leasing and management of the new property. (Some units are reserved for those who earn no more than 30 percent of AMI. Applications will be available November 1.)

The coming years will also likely see more housing built at the affordable-housing complex on Bridge Street—possibly small homes and cottages that may include some for sale to income-limited residents. A Habitat for Humanity-developed project on North Plain Road in Housatonic will, according to early plans, provide 19 new affordable homes. The seven acres of land for that project were acquired by Great Barrington’s Affordable Housing Trust using $175,000 granted from the town’s Community Preservation Act (CPA) fund.

A project guided by Construct is also taking shape in nearby New Marlborough for 13 affordable units at the Cassilis Farm property, supported by $217,500 from that town’s ARPA funds. Completing renovations will take several more years, with full occupancy not expected until 2025.

And a local restaurateur, frustrated with his housing-related staffing challenges, is working with Construct and others on a plan to transform a local bed-and-breakfast inn into so-called “congregate” employee housing—a potentially innovative idea but one that will have to navigate concerns about linking housing directly to one’s employer and whether it bumps into any zoning or health-code requirements. And also ensure the town will get behind this kind of project.

Indeed, when the concept came up for preliminary discussion at an October 13 Planning Board meeting, board chair Brandee Nelson expressed concern that this type of housing would meet pushback from the public—and particularly from neighbors. She hinted strongly that the board would tread cautiously in areas where it feared a strong not-in-my-backyard (NIMBY) response, while other members, including Pedro Pachano and Jeremy Higa, argued in favor of the concept.

The key word in many of these project descriptions? “Years.” Already behind the ball on housing policy and production when the pandemic hit, the rate of new housing development in the region is widely considered too slow to address the urgent need. And that need is not just for lower-income residents: There’s a shortage of both available and affordable housing for the so-called “missing middle” that includes teachers, firefighters, nurses, and others with incomes at and above the area’s median income.

Windrush Commons—a vital CDCSB project that took more than five years to realize—is reflective of the pace of affordable-housing development, which that group’s president, Lenox architect Jim Harwood, has called “geologic.” Aside from finding available land that provides a workable site with access to water-and-sewer infrastructure, this flavor of housing construction relies on assembling a headache-inducing and complex mix of state and federal funds, private and nonprofit financing sources, and tax incentives. And it must also abide by a lengthy list of well-intentioned state policies and important fair-housing guidelines that promote economic and racial diversity.

“That’s why I have a job,” joked June Wolfe, who works as Construct’s housing director, during a recent deep-in-the-weeds conversation about how the financing, construction, marketing, and lease-up of these heavily subsidized developments all come together to eventually produce affordable places for people to live.

Yet talk to a business owner struggling with staffing or longtime residents priced out of their community and they’ll tell you that “years” is too long to wait. Some downtown businesses may not survive five months, much less five years, as owners limit operating hours and stretch themselves and their staffs to the breaking point. The ripple effects and economic and social feedback loops from these problems are myriad. And growing.

Rasch has quite a lot to say about all of this. Over the course of multiple interviews and an e-mail correspondence that began before Labor Day, we discussed many aspects of housing, zoning and permitting, local construction, sustainable building design, local retail in the age of Amazon, and his vision for downtown Great Barrington. He proposed ways to bring together town government, nonprofits, private developers, and community members to chart a path forward that meets the need for affordable, workforce, and market-rate housing. (“It’s not that complicated,” he told me.)

We also discussed ways to expand affordable housing options for resident workers and how he thinks he can help—even while building expensive new apartments. Amid concerns that his current and future projects will exacerbate, and not remedy, the local workforce- and resident-housing crisis, he told me several times that he’s “100-percent committed to solving the mixed-income problem” in downtown Great Barrington and described his thinking about how to do it.

Much of what he offered was thoughtful, earnest, and well-reasoned. All of it is quite ambitious—intellectually, logistically, and certainly financially. He also displayed a fascinating mix of clear-eyed realism tinged, perhaps, with a few blind spots regarding the impact of what he called “responsible gentrification” on lower-income workers and families in this environment.

That was evident when evaluating his admirable interest in creating what he describes as “an economically resilient, mixed-income, walkable downtown.” It’s a vision that, based on his proposals for how to underwrite affordable units in his projects-in-progress, noticeably excludes those at the lowest end of the income scale. That refers to at least some of the full-time residents who currently live in the aging but quite affordable downtown housing that he’ll renovate and make far more expensive. But it also includes most of the lower-income residents of those existing and planned affordable-housing developments he says are helpful but not ideal as they segregate the less-well-off on the outskirts of town. (He called that model “horrible.”)

How he responds to community sensitivities around these issues will help determine how smooth or rocky his road is from here—and also whether he can establish productive partnerships with local governments and housing advocates to help advance important goals on housing.

What I also took away from our many hours of conversation is Rasch’s willingness to try to solve—often on his own dime—longstanding and complex problems at the intersection of public interest and private property. Some of those, like crumbling shared infrastructure in the alley between the Mahaiwe Block and some Railroad Street buildings, have been largely ignored by the town and other property owners for years. And while the heart of his plan for the Prospect Lake Park campground is sure to irk many, his commitment to create new public access and other opportunities for community use appear substantial and genuine.

Not surprisingly, Rasch has a private-developer’s take on how to accelerate the creation of affordable and market-rate housing while advancing important sustainability, historic preservation, and economic-development goals. Spoiler alert: It focuses largely on privately funded development. But he also has important ideas for ways to piggyback public funds onto his faster-paced housing development to speed creation of at least some affordable units.

As Rasch is almost certain to play a significant role in the region’s housing and economic landscape in the coming years, this seven-part Edge In Focus series provides an in-depth examination of his vision, current projects, and approach to real-estate and economic development. It includes previously unreported details about Alander projects underway in downtown Great Barrington and Egremont, as well as an in-depth look at the controversy surrounding that $250,000 historic-preservation grant for a project that changed dramatically not long after funds were approved by town voters.

Finally, it examines whether Great Barrington’s approach to the housing crisis needs a kick-start, with far bolder action that reflects the urgency of the moment. To that end, the series will conclude with a look at how some other tourism-based and second-home-heavy communities around the country are addressing their housing-related struggles, and whether Rasch’s plans align with ideas that could work here.

Born and raised in the region

Rasch is a local. He grew up in Columbia County, where his social-worker parents raised him and two sisters at Camphill Village Copake, a community of families and volunteers who live alongside adults with special needs. He earned a degree in music from Oberlin College and, later, a master’s degree from New York University’s Schack Institute of Real Estate, where he focused on architecture, construction management, and real-estate finance.

A classically trained cellist, he also took classes at Juilliard, the prestigious New York performing-arts school, and sometimes played during summers at Colorado’s Aspen Music Festival and School. Growing up, he studied locally with Yehuda Hanani, the renowned cellist and artistic director of Close Encounters with Music which presents concerts at the Mahaiwe Theater for the Performing Arts and educational opportunities via the annual High Peaks Music Festival, held most recently at The Berkshire School in Sheffield this past July.

Back in his early twenties, Rasch said he watched an 11-year-old prodigy at Aspen flawlessly perform a technically complex Wieniawski violin concerto and realized that he might not have what it takes for a music career. “I was just like, ‘Oh my god, this is sort of game over, I’m never going to compete with that,’” he said, calling it his “what-am-I-going-to-do-with-my-life moment.”

His Swiss father had often brought him to New York and throughout Europe. That sparked an interest in architecture, and, unsure what to do next, Rasch enrolled at NYU in 2004 and began a career in real-estate development in New York City.

Sitting at a metal table outside 47 Railroad, the mixed-use complex at the top of Railroad Street he built in partnership with fellow developer Sam Nickerson, Rasch linked his musical background to his current work. He told me that “architecture is music frozen in time,” roughly quoting Goethe, and described what attracted him to real-estate development.

“The confluence of people. I mean, you build buildings, you create spaces, and architecturally that’s really interesting to me. And from a planning perspective. But the most interesting piece is, you know, this disparate assemblage of people, contractors, architects, engineers, and then at the end, tenants and stakeholders that actually use your space,” he said, motioning around the large brick patio alongside the building, which was restored with an eye to Great Barrington’s historic look and feel. “Being able to create an environment like this.”

After relocating back to the region from Brooklyn in 2008 with his wife, Jade-Snow Carroll, a designer who also grew up nearby, Rasch volunteered at CDCSB, collaborating with former Executive Director Tim Geller on early plans and environmental remediation efforts at the Bridge Street property that would, a decade later, become home to Bentley Apartments. That’s the affordable-housing development located atop the contaminated former New England Log Homes site and built next to the town’s sewage-treatment plant. It has 45 less-expensive rental units reserved for those earning no more than 30 percent of area median income. A one-bedroom apartment at Bentley costs around $700, not including utilities.

In 2011, Rasch joined Allegrone Companies as vice president and director of development. In that role he worked with the city of Pittsfield on local implementation of the state’s Housing Development Incentive Program (HDIP), which offers tax exemptions for development of market-rate housing in gateway cities. Those are midsize urban centers that anchor regional economies that are also confronting social and economic challenges.

With help from new HDIP tax incentives, he led Allegrone’s successful redevelopment of two historic properties in Pittsfield, the Onota and Howard buildings. At the time, the struggling former General Electric company town was a decade into economic-development efforts that focused on attracting so-called “cultural creatives” and others to its downtown corridor. Building attractive market-rate housing was vital.

C.J. Hoss, who has been Pittsfield’s city planner since 2011, worked with Rasch on permitting those projects. He told me that whenever he’s seen Rasch since then, he asks when he’s coming back to Pittsfield. “From a permitting perspective, he was someone great to work with,” Hoss said. “He was someone who was always very thorough, and followed through on his word, and he was trusted throughout the process. I’d be happy to see him come back with another project.”

After building a passive-solar house and renovating a second unique property in Hillsdale, New York—both of which made appearances in The New York Times and Architectural Digest—Rasch now lives in a family compound at the top of Baldwin Hill in Egremont. It features a restored 19th-century farmhouse and reimagined historic barn that is home to both his mother and mother-in-law, all on 15 acres. That project, completed in 2020, was also profiled in The New York Times, scoring a hat trick of media praise for the design and aesthetics of projects he and Carroll worked on together.

Since leaving Allegrone in 2015, Rasch has quietly built Alander, a company he calls a “vertically integrated builder-developer-owner,” into a substantial enterprise. It consists of Alander Construction, established with longtime friend Roman Montano that primarily builds multi-million-dollar luxury homes and is also deployed for large projects like the Mahaiwe Block and 343 Main, and Alander Group, the umbrella for his investor-backed real-estate development.

With what he said are “seven to 10” construction and development projects at various stages at any given time, Rasch’s staffing needs are significant. His company employs roughly 20 full-time architects, engineers, project supervisors, and others. He said he pays “well in excess of the median income,” cognizant of the cost of living in the Berkshires—especially, and perhaps ironically, for housing. He’s also quite aware of local competition for a limited pool of experienced contractors. He said his lowest-paid full-time carpenter earns $75,000 per year.

“That’s the most important investment for me,” Rasch said, pointing across the street to Alander’s second-floor offices at 40 Railroad Street, a building owned by local developer Richard Stanley—and one that Rasch told me he hopes to acquire for redevelopment.

He described his company as a mixture of “architects and engineers in their 20s and 30s” and older tradespeople in their 50s. “You need both,” he said. “If you remove those craftsmen, we could sit up there drawing circles all day long and we’re not going to get anything built. So we really try to invest in our people. That’s what you have to do here.”

It’s proven to be a smart investment. Alander’s size and in-house expertise provides scale, labor availability, and efficiencies as it takes on multiple projects in a tight construction-labor market. And making the financials work for his downtown-redevelopment projects—including finding a path to reserving some apartments for income-limited residents—gets a lift from the size and scope of his enterprise.

“The only way we can make it work is because we’re not taking a developer fee or a contractor fee,” he said, referring to large expenses commonly added to affordable-housing projects. “And [therefore] our cost per unit is going to be much less than someone that has to go out and hire all those people.”

He told me that Alander Construction was well-positioned during the first year of the pandemic when demand rose for new and renovated high-end homes in the area. The wobbly economic moment in mid-2020 didn’t really impact his clients.

“These are high-income individuals for whom this is their second, third, or fourth house and they’re not constrained by the markets,” he said.

While just a few years ago Rasch was building houses for $1 million to $2 million, Alander’s home-building projects are now often two or three times that price. His description of those residential clients, and particularly the type of decisions they face while constructing their luxury homes, is likely to make some heads explode.

“Some of the work on the high end is challenging in that there’s a lot of fussing over [questions like], ‘Are you buying a $250,000 French oven? Or are you buying something that’s more reasonable?’ And that part is challenging for me,” he said. “But I guess what I would say is those projects afford us the opportunity to pay people what they really need to get paid.”

For someone who built a passive-solar home more than a decade ago with annual heating-and-cooling costs of around $63, and who quotes Wendell Berry, dreams of building energy net-positive buildings and whose multi-use downtown buildings are super-insulated, use electric heat pumps, and incorporate as much solar as possible, it seems odd that he also builds enormous vacation homes.

He’s not unaware. “I still find it really interesting that we’re building these massive houses that are so resource-intensive,” he conceded, noting that while he can make recommendations to clients for sustainable and energy-efficient options, they make the decisions. He said that some projects incorporate PV offset, which means that on-site solar energy covers some portion of energy use.

Rapidly climbing land values have had a significant impact on the cost of those new homes in the region. But it’s also due to the cost of skilled contractors. “It’s very challenging to build something for a million dollars today. And that seems crazy,” Rasch said. “But part of that’s a function of the subcontractor and labor trades here. They’re used to building second homes, so they charge appropriately.”

That challenge has hung over downtown retail-and-housing redevelopment for some time. In a 2017 Edge story about downtown business, Rob Navarino, owner of The Chef’s Shop and its Railroad Street building, pointed to those costs as burdensome for building owners who want to renovate. Large renovation expenses mean they’d have to charge substantially higher rents to their commercial and residential tenants.

Similarly, developer Richard Stanley, who owns the Barrington House mixed-use residential building on Main Street and other properties in Great Barrington and Pittsfield, told me this summer that over the decades he’s sometimes considered renovating his apartments. But he said the math didn’t work for him, in terms of what he thought he could recoup via higher rents. That’s left aging, less-attractive housing stock that Rasch argues will need significant investment to renovate and bring up to modern building codes.

Rasch told me the town could make a significant difference on this longstanding challenge by allocating historic-restoration and other funds to help current downtown property owners invest in their older buildings. That includes exploring ways to phase in the higher taxes that come with renovating a building and increasing its assessed value.

That way, he said, existing owners could add sprinkler systems or renovate apartments and make other upgrades. That would help prevent the kind of rapid deterioration that requires someone like him “to show up and take it all on,” he said, with expensive-but-necessary investments that can only be recouped with substantially higher rents.

With precisely that kind of “take it all on” work to begin shortly at the freshly acquired Mahaiwe Block, his private-equity-backed development group is ready and eager to do more of it over the coming decade.

NEXT: In part two, why Alander’s investor-backed development group has an advantage as it seeks opportunities in downtown Great Barrington. Also explored are Rasch’s views on zoning, how he proposes to make some of his luxury apartments affordable, and his surprising take on a failed effort to build 45 apartments at the end of Manville Street in 2018.

∎ ∎ ∎

(This series first appeared in The Berkshire Edge.)

Have thoughts? Submit a letter to the editor.