Rasch says his formula for acquisition and redevelopment will help to create a “mixed-income” downtown in Great Barrington. Is he right?

∎ ∎ ∎

Alander Group, Ian Rasch’s investor-backed umbrella organization, owns a growing list of local real estate. Among his rental properties are 10 Maple Street, near the roundabout, which he acquired for $1.4 million in a 2018 foreclosure sale and currently leases to Berkshire Health Systems (BHS) for its Fairview Rehabilitation practice and other BHS medical facilities. He also owns 780 South Main Street, which he purchased a few years ago from the East Mountain Medical practice group and then rented back to them. (East Mountain Medical is now part of BHS.)

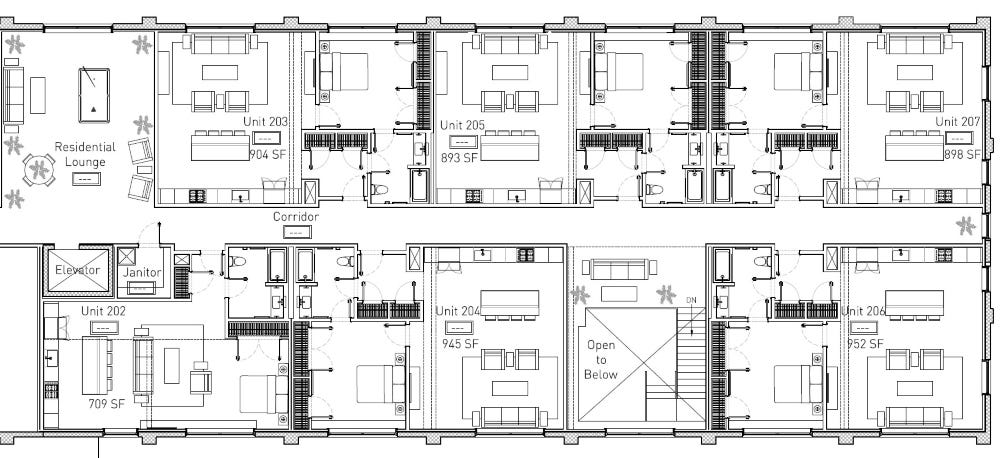

His more recent purchases include 343 Main Street, the former Berkshire Community College building, and the Mahaiwe Block, which he acquired this week for $3.5 million. After renovations to both buildings are completed later next year and in 2024, respectively, the two buildings will offer a total of 35 upscale, primarily one-bedroom apartments.

And last winter, Rasch made a $2.5 million outlay for the Prospect Lake Park campground and an adjacent house in Egremont, where he’s spending heavily to transform the property—popular with season-long campers—into something quite different than what it’s been for at least half a century.

All are financed in part by private-equity investors who participate in individual projects. When he began real-estate development here, he told me, he had discussions with New York City-based investors involved in his work there. “They were like, ‘Why Great Barrington? We don’t really know the market.’” So Rasch sought out local investors. “I mean, there are very well-heeled individuals in and around the Berkshires who are also looking for a return, and maybe have an interest in investing in downtown housing and things like that.”

All of them, he said, “have a presence in the Berkshires, some full time and some have a second home.” He described his financial partners as “patient capital investors” who sign on to indefinite investments, all of which, so far, have featured commercial or mixed-use rentals. (Alander’s website promises investors “high-quality commercial assets that preserve capital and provide reliable cash flow.”)

“There’s no time limit on how long we hold and there’s no requirement that we have to generate ‘X’ return,” he said.

Rasch told me that his investors have encouraged him to diversify by taking on projects outside the region. While that may happen, he said, his primary focus will remain local. “I feel like mixed-use historic-redevelopment projects in the town that I live in, in the town where I walk the streets every day … I see everybody, I know the superintendents, I know the town planners—that’s how I can make a difference,” he said.

He compared his focus on local projects to the onshoring of manufacturing jobs. “It’s important for me to invest capital, time, and resources here, where I’m accountable to it.”

Until this year, Rasch was probably best known for his co-ownership of 47 Railroad, which he built in 2018 with another local developer, Sam Nickerson. It includes five ground-floor commercial spaces including upscale restaurant/bar MoonCloud; the Marjoram + Roux café, and Familiar Trees, an art-and-architecture-focused bookstore.

Upstairs are 13 one- and two-bedroom apartments rented to a mix of full- and part-time residents. Since the building opened to tenants in 2018, rent for newly leased units has already increased to $2,500 (1BR) and $3,500 (2BR) per month—a sharp rise of 30 percent in just four years, according to a June 2022 market study Rasch commissioned earlier this year and shared with The Edge.

The study, produced for the proposed Mahaiwe Block acquisition by the Wellesley, Massachusetts-based LDS Consulting Group, LLC, is a typical part of a real-estate development project. Mortgage lenders and private-equity investors want to be certain that demand is sufficient, the property will succeed, and that the financial risk is manageable.

On the question of affordable downtown apartments—and affordable housing in general—Rasch concedes that 47 Railroad “is not helping to solve that problem.” That may leave some wondering about his new public commitment to mixed income and affordable downtown housing that might help meet pressing needs for local working families.

Indeed, the study noted that “most would-be renters are coming from outside the Study Area [Great Barrington, Stockbridge, Lenox],” which suggests his new apartments in both 343 Main and the Mahaiwe Block are as likely to attract new, more affluent full- and part-time residents as they are to provide housing for those already here and struggling.

The study also noted the stunning 67-percent increase in Great Barrington properties used as second homes and for seasonal, or short-term, rentals from 2015 to 2020—which doesn’t include the full impact of the pandemic. (That means limits on short-term rentals that take effect next year in Great Barrington are both important and perhaps too late.)

This trend presents an opportunity to rent to “locals being pushed out of the rental market and seasonal residents or visitors who may not be interested in buying a second home but who would like to relocate seasonally”—the latter meaning part-time residents who will rent a luxury downtown apartment as a second home.

That doesn’t rule out some modest positive impact for lower- and middle-income residents who can’t afford Rasch’s apartments. Housing advocates argue that some amount of new high-end housing in a tight market will free up moderately priced units when some step up to nicer apartments.

Still, the study’s evaluation of demand for new apartments in the Mahaiwe Block repeatedly noted the appeal to older people who might relocate to Great Barrington: “… A new development will likely be attractive to aging homeowners seeking maintenance-free single-level living in an elevator building … We assumed [in our demand analysis] that all the renters would come from our narrow Study Area which is overly conservative given that we know existing tenants at 47 [Railroad] come from outside of the Berkshires.”

The research report highlighted skyrocketing home prices “inflated by out-of-state seasonal-home purchasers” that could make his amenity-rich rentals attractive to “younger adults who are unwilling or unable to purchase a home” and “seniors who may be looking to downsize but are likely not yet old enough to need significant care.”

Additional evidence of a mismatch comes from 47 Railroad’s considerable waiting list, which Rasch told me currently has 70 names. His partner in the project, Sam Nickerson, told a July 2019 joint meeting of the Select Board and Planning Board that many of those waiting to rent their high-end downtown apartments are seniors looking to downsize.

“The old housing stock just doesn’t work,” Nickerson explained to the board members. “It’s not accessible. It doesn’t have elevators, so you really need to fit the need that’s here.” Of the waiting list, which three years ago he said stood at 30, Nickerson said, “A lot of them are seniors who need this because the existing housing stock is just not getting the job done.”

Rasch told me recently about accessibility modifications he’s already made to some apartments at 47 Railroad. And that his new downtown apartments will include more amenities and features helpful to older renters.

Overall, the study’s findings suggest the need for housing affordable to a range of local workers won’t be met by Rasch’s new apartments, even though there’s likely to be significant demand.

Can some of these units be set aside, through subsidies and other financing options that enable lower rents, while ensuring Rasch’s financials “pencil out?” That’s particularly important considering that redevelopment of the Mahaiwe Block and similar buildings will replace generally affordable—if outdated—downtown apartments with substantially more expensive ones.

Rasch’s view is that deteriorating downtown buildings eventually need that substantial investment—some sooner than others. He described the Mahaiwe Block as “a ticking time bomb” that “might not be habitable in a year or two” because of problems like deferred maintenance, water leaks, and a currently nonfunctioning 40-year-old heating system.

Not surprisingly, he thinks investing taxpayer funds and other local financial resources into his projects to underwrite some affordable units makes sense. “I would say that the town, and Construct, the Community Development Corporation (CDC), Berkshire Housing, myself, and employers should take this seriously and say, ‘Okay, there’s two projects about to start, and let’s say there’s going to be five more over the next 10 years in town,’” he said. “Let’s find a meaningful way to get some designation of 60-percent [area median income] deed-restricted units, 80-percent units, 100-percent and 120-percent units and make that the focus,” he said, using the standard metrics used to describe income levels in housing discussions.

“Don’t just continue to build standalone segregated housing,” he said, describing affordable developments built exclusively for lower-income residents and seniors. “That’s better than nothing, for sure, but it doesn’t really solve the long-term problem.”

As a back-of-the-envelope example, Rasch said that if an apartment in one of his downtown buildings cost $400,000 to build, he might seek an average of $200,000 from the town and other sources to enable him to reserve that unit, for 20 years, for those earning between 60 to 120 percent of area median income.

“From a value perspective and a return on public investment, that’s the best opportunity I see,” he said. “We want to get quality housing that’s in the downtown core, and we want it done quickly, not over the course of an exponentially long period of time.” He’s referring to the typically years-long process of acquiring public-sector financing and tax incentives for stand-alone affordable housing.

Rasch plans to seek grants from the town to help make that happen, including applications he’ll file this fall for grants from the town’s Community Preservation Act (CPA) funds. Those annual awards are made in four areas: affordable and community housing, historic preservation, open space, and recreation. (The CPA grant awarded this year for 343 Main Street was for historical preservation.)

He’s started conversations with town officials about funding to subsidize perhaps 20 percent of his new units. That would be seven of an expected 35 new apartments. (Early plans show four of the planned units in the two buildings will be studios, which would be less expensive to subsidize.)

Rasch also told me that Alander will consider internalizing the cost of subsidizing affordable units if he’s unable to secure CPA or other town funding. That might involve an investment pool with a lower rate of return. That model might be of interest to affluent residents and second-home owners who want to help address the housing crisis—something Betsy Andrus, executive director of the Southern Berkshire Chamber of Commerce, floated back in the spring when she told me she hoped wealthy local investors might step in to help with housing development.

But importantly, Rasch said that without town support, those affordable units would have to be at the higher end of affordability, only for people at, or slightly above, the area median income.

And while this may ruffle some feathers, Rasch also suggested that money donated to various local housing and social-service nonprofits could be better spent by directly subsidizing affordable units in his new buildings.

“There’s an enormous amount of money in this community that’s funding social service and health organizations … so from my perspective, it’s taking those resources and putting them to use in a much more effective way,” he said. He again noted the time-to-market and return-on-investment that he says his projects offer. “It’s just using what’s there and adapting it slightly.”

Rasch’s private-sector experience has given him a private-sector perspective. “One of the things I’ve learned is you can’t always wait for subsidies, you can’t wait for the Planning Board to sign off, you have to go as an individual,” he told me. “And in order to solve these problems, we need to come up with creative, nimble solutions that are not going to be mandated by the state. Because [that] just takes too long.”

Support for zoning and permitting changes

To bring down the cost of housing development, Rasch favors changes to reduce the expense of project permitting. That’s a common refrain from developers everywhere, but one that’s being listened to closely because of today’s inflated construction costs.

“Very few projects of any scale get done here because the permitting is so complex,” he said. “And it’s not just that it’s complex. It’s expensive. It’s too onerous.”

Improvements, he argues, could mean more housing of all kinds. “Simplify the zoning so me, you, anybody can see a very clear path to creating two units at a time, three units at a time,” he said. “You don’t want to just have big projects. You want those old houses [in] the hill [neighborhood] converted to duplexes. And so incrementally, you’ll add way more housing if we’re all involved in it and it’s the responsibility of not just me and Construct and the CDC.”

The Planning Board has in recent years made zoning changes to enable the creation of more multi-family housing and addition of accessory-dwelling units without the need for special permits.

As he and Nickerson pointed out during public meetings about their Manville Street project, very little multi-family housing has been built south of Pittsfield in decades. They argue it’s because zoning and permitting challenges can require multiple appearances before various boards with lawyers, engineers, and consultants who charge them by the hour.

“If you look around, for the last 20 years, I mean, you can count on one hand the projects that actually got built here,” Rasch told me.

That’s another reason Rasch and others, including the Planning Board, have focused on changing zoning bylaws put in place years ago that were meant, to use a loaded phrase, “to preserve the character of neighborhoods.” That’s coded language long meant to block construction of housing that works to create more economic and racial diversity. Housing activists argue that a lot of zoning across the country is outdated, unhelpful, unfair, and stands in the way of building needed housing for everyone.

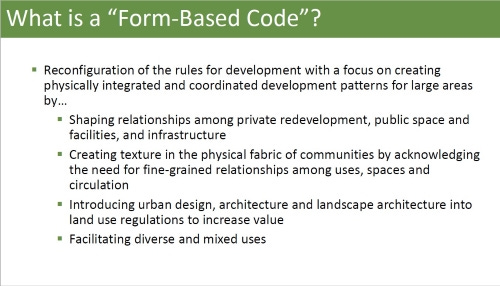

One approach Rasch champions is “form-based codes.” That’s zoning that, particularly with respect to downtowns and village centers, focuses on scale, type of building facades, and how structures interact with public space, rather than just a focus on a property’s use. It can eliminate complexity and, by extension, simplify and reduce the cost of permitting.

Last year, Pittsfield adopted a form-based code for its downtown district to encourage new housing development, the reuse of historic and underutilized buildings, and promote downtown vibrancy. That includes encouraging some ground-floor uses allowed “by right,” or without special permitting, like museums, restaurants, arts-related shops, and even artist housing.

Great Barrington might benefit if it followed suit. For example, it has many downtown-vibrancy-draining enterprises like real-estate firms and law offices taking up valuable Main Street storefronts in the village core. While important businesses, they’re not the kind of traffic generators that promote economic activity in a small-but-critical downtown.

Pittsfield’s downtown form-based code is designed to push that type use onto secondary streets. (The Great Barrington Planning Board briefly discussed the issue of downtown ground-floor uses in 2017 but took no action.)

Overall, form-based code allows developers who follow the guidelines to avoid time-consuming and costly permitting while still delivering results in line with articulated community goals. While the debate in Pittsfield over the change included some concern about waiving certain affordable-housing requirements, there’s no reason those can’t be included.

Great Barrington hasn’t mandated that downtown housing redevelopment include a certain percentage of affordable units. Those requirements, generally known as “inclusionary zoning,” are often combined with tax or other incentives to developers like increased density, taller buildings, or tax abatements. Finding the right balance can attract developers to add affordable-housing inventory.

When I spoke recently on a joint call with Mark Pruhenski and Chris Rembold, Great Barrington’s town manager and planner, respectively, they described two recent meetings with Rasch. “We talked about his projects and how we might be able to collaborate to keep some units affordable,” Pruhenski told me.

Rembold—whose full title is “assistant town manager and director of planning and community development,” a trio of municipal hats that suggests the town should put more resources against the work of his single-person Planning Department—pointed out that costs to maintain older buildings are substantial. That’s also true for renovating them to include modern requirements like fire suppression, insulation, elevators, and Americans with Disabilities Act (ADA)-required accessibility features.

He said Rasch shared preliminary information about development costs for his two downtown projects and what it might cost to create some lower-rent units. But there wasn’t any discussion of where those subsidies would come from. Or if the town considered them worthy projects.

“Certainly, in general, housing in downtown, and low-cost and affordable housing in downtown, is a very good thing,” Rembold said. “And maintaining any of the existing apartments that are [currently] low cost as low cost would be great.”

It’s too early to say what might happen. “We’ve not had any discussion about should the town do it, will the town do it, how will the town do it,” Rembold said. He highlighted potential sources of funds, including a budget allocation from town meeting, CPA or ARPA grants, or funds from the town’s Affordable Housing Trust.

Select Board chair Steve Bannon also met with Rasch recently for an update on his projects but didn’t disclose details of their conversation or if town-financed subsidies were discussed. “He just wanted to be open,” Bannon told me earlier this month. “We’ve always had a good relationship with Ian.”

In essence, Rasch’s argument is that public funds in the form of state and federal grants, loans, and tax incentives are already being used for subsidized housing like Bentley Apartments and Windrush Commons—and at a much higher taxpayer cost per unit than his redevelopment projects offer. And that’s for housing that can take five years or more to materialize and that’s not integrated into mixed-income neighborhoods.

He told me that he sees the potential for 100-to-200 housing units renovated or added to downtown Great Barrington over the next 10 years. Those numbers are possible with the conversion of some upstairs office space no longer needed in the era of remote work. (The second floor of the Mahaiwe Block was formerly all small-office spaces.)

So, if 20 percent of those 200 units are made affordable for residents at Rasch’s proposed 60-to-120 percent AMI, that’s 40 units. Is that enough? And at the right income-cap levels? What about those at the lower income level of 30 percent AMI, like those who income-qualify for Bentley Apartments and some of the units at the coming Windrush Commons on South Main Street? That group includes artists, writers, staff at downtown restaurants and grocery stores, employees of small nonprofits, and many others who earn modest incomes but keep our community vibrant and our local economy working for everyone.

Here’s where a clear housing action plan with good data about what exists today and what’s needed going forward would help. It would have specific, year-over-year goals for the community, with number of units needed, at what levels of affordability. And it would make these choices and associated costs easier to evaluate.

Construct’s June Wolfe told me that she’s “very much in favor of private developers incorporating affordable units into their projects.” She said benefits include reduced economic segregation and stigma and increased income mobility. And with greater public understanding of the housing crisis in recent years, she said public opinion has put pressure on private developers to get involved.

“We have developers who are aware of the problem and want to do something to fix it,” Wolfe said. Still, they need to make up rent income from units reserved at lower-than-market rents. Wolfe thinks “there needs to be some compromise on that,” in part by asking developers to cover the difference by charging more for some of their market-rate units.

Given that money to underwrite affordable units in market-rate buildings would largely come from tax dollars deployed to maintain a developer’s bottom line and, in the case of Rasch’s projects, his investors’ returns, perhaps it’s fair to ask: What if Rasch, or developers in general, made less money?

The question of developer profits during a housing crisis might be a useful discussion if armies of developers were fighting it out to spend millions to redevelop our downtown buildings or construct new ones. But there’s little interest here because the projects are generally too small. And in the case of 100-year-old buildings like the Mahaiwe Block, complex and expensive.

This local reality aligns with Rasch’s skill set, his company’s resources, and his strategy to hold properties for an extended period to recoup significant initial investment. And it also syncs with his interest in pursuing projects in his community, even if they’re less profitable than what he could earn from larger real-estate projects elsewhere.

William “Smitty” Pignatelli, who has represented Great Barrington and 19 other primarily south Berkshire County communities in the state legislature since 2003, told me that developers he meets aren’t interested in pursuing projects in the small communities in his district. They prefer places where they can build more profitable complexes with hundreds of units.

He suggested the state could offer financial incentives to developers to take on needed projects in smaller towns. While he couldn’t point to any legislation he’s introduced or co-sponsored to advance those ideas, he said he thinks there’s interest at the state level to “reboot the conversation” about how best to distribute state and federal money for housing development.

Pignatelli also sees a role for municipalities to support new housing development by taking on the cost of things like new sewer and water infrastructure that projects may need, perhaps with help from state grants and zero-interest loans. He also supports offering incentives, like CPA grants, which enable a developer to reserve “a small percentage” of units as affordable. “I think the town could play a very important role,” he said.

The lack of developer interest or ability has played out for years in Housatonic. To wit: The latest request-for-proposals for the redevelopment of the Housatonic School received only two applications from developers who advanced plans for housing. (The other two proposals were for a business incubator/training center and for a “Museum of Body Arts” dedicated to hair and make-up design.)

The good news is that both proposals seem promising. As the review process continues in front of the Select Board on October 24, the discussion will certainly include the path to designating some apartments as affordable.

The proposal from Williamstown developer David Carver to create 10 two-bedroom apartments has offered to limit tenants to those earning no more than 100 percent of area median income—the low end of the so-called “missing middle.” His projected income-and-expense statement listed monthly rent for each two-bedroom unit at $1,750.

And a plan for the property from Nanuet, New York’s Arete Ventures named “New Housatonic Place” would build a mixed-use complex featuring 14 one- and two-bedroom apartments along with a “community flex space” to be used by a retail business and local nonprofits. The developers said they’d commit to three affordable units, pending town support.

Lessons from Manville Place

One of the more interesting conversations I had with Rasch about zoning and housing development was about the large project he and Nickerson proposed in 2018 on Manville Street. It would have created a complex of three buildings featuring 45 market-rate apartments at the end of a quiet, dead-end street.

Called “Manville Place,” it was located in the “mixed-use transitional zone,” dubbed “MXD,” advanced by the Planning Board a couple of years earlier to allow mixed-use and multi-unit residential development in that part of town. It was previously zoned for commercial use, potentially leaving the neighborhood open to construction of large commercial buildings or even a big-box store.

Two years after it was first proposed, Manville Street neighbors successfully sued the town to block the project. It was abandoned in 2020.

In addition to the size of the complex and the impact it would have on residents of a sparsely populated street, some residents complained that Rasch and Nickerson’s plans, and promises, kept changing. Many felt the zoning change that enabled a large residential development as long as it contained at least one commercial entity—to qualify as mixed-use—was a loophole waiting to be exploited.

At least on paper, Rasch and Nickerson’s concept was in many ways compelling: Extend a residential corridor that would connect housing and light commercial activity, like a small café or yoga studio, in creative, walkable ways with the rest of downtown, and add a significant number of new housing units that included common greenspace (how much greenspace seemed a moving target to the project’s critics).

A lot of time and money went into trying to move the project forward, so Rasch surprised me when he said he now thinks the project was a bad idea—and not because of his lost time and money.

“I’m deeply sympathetic to the people on Manville. And you know, it probably wasn’t the right project for that street,” he said. “It’s a beautiful street. It should stay just like it is. There are way more opportunities [for new housing] on Railroad Street, on Bridge Street, on Main Street.”

He described the “massive impact” his project would have had on the street’s longtime residents. But he also, in part, blamed the town’s process for creating the new zoning district that made the project possible. He described the discussion around the zoning change that went through the Planning Board, with the help of a consultant, as “academic,” and suggested the town should have engaged residents more explicitly in the process. That way they wouldn’t first learn of the change when Rasch and Nickerson proposed their project.

He said there should have been community meetings that included developers, potentially impacted residents, and town officials to discuss its likely effects and examine parameters like the height of buildings and unit density. That, he suggested, would have led to a better result. “That discussion should have happened [earlier], versus the abutters finding out when our permits were filed,” he said.

With hindsight, Rasch described how he might have reacted to his own project. “If I lived on that street, and some random person shows up that I don’t know anything about and says, ‘We’re going to build these 45 units, it’s going to be fantastic. Don’t worry about it, you’re going to lose a little bit of public space but just trust me, it’s going to be great,’ I would have done the exact same thing,” Rasch said. “Which is to be very apprehensive, very concerned, and probably throw my arms up and push back as much as I could.”

Whether that’s just public-relations spin about a long-dead project or a genuine change-of-heart is hard to say. But it does, at least, speak to whether broader community conversations would be helpful on the path forward on zoning and housing development to make it less technical and more upfront about likely real-world impacts.

To be fair, the Planning Board discussed the proposed change in numerous public meetings. It was approved by voters at town meeting in 2016. Though, to Rasch’s point, zoning-reform discussions at Planning Board meetings don’t often rank high on the list of choices for an evening’s entertainment.

As for the investment he and Nickerson made, Rasch said they were “bailed out by COVID.” They renovated the three houses they had purchased to secure land for the site and flipped them in the hot pandemic housing market. Earlier, they had offered to donate two of the houses to Construct, which hoped to relocate them to town-owned land in Egremont where they would be renovated and sold as affordable homes.

Unquestionably, the Manville Place experience turned Rasch’s focus to downtown redevelopment, where issues with neighbors and abutters are far less likely. Now, instead of constructing new buildings, Rasch’s goal of adding housing units by redeveloping existing mixed-use downtown buildings is about to be be road-tested at the Mahaiwe Block.

∎ ∎ ∎

NEXT: In part three, more details about the Mahaiwe Block sale, what happened to the building’s tenants, Rasch’s efforts to help a few relocate, and the developer’s thinking about the retail portion of his mixed-use developments.