As negotiations with the BCC Foundation dragged on and tenants dropped out, the hot real-estate market and an unexpected expense changed the calculus.

∎ ∎ ∎

To learn more about how, why, and when real-estate developer Ian Rasch’s 343 Main Street project in Great Barrington had morphed from a culinary training and health-and-wellness center to large, upscale apartments, and answer questions relevant to his $250,000 historical-restoration grant from the town of Great Barrington, I first reached out to every organization that had planned to occupy the renovated building next year. All had, by June 2021, signed letters of intent (LOI) to rent space.

Some of their explanations lined up with Rasch’s. Others didn’t—in a few cases quite significantly. All of the conversations revealed surprising details.

Overall, what I found reflected the complexities of real-estate redevelopment projects; puffery, unjustified certainty, and a concerning timeline regarding Rasch’s application for local and state grants; and, ultimately, a developer’s interest in a financially successful project. That last goal became particularly clear when considering the broader economic moment: Great Barrington and South Berkshire County were in the midst of a pandemic-fueled rise in residential real-estate values that dramatically tightened the market for both home purchases and residential rentals—just as Rasch was losing some of his anticipated commercial tenants.

My first discovery was that not all tenants “fell by the wayside” this year, as Rasch told me a few weeks ago.

In mid-September, when I contacted Andrea Wadsworth, Berkshire Community College’s (BCC) vice president of administration and finance, about the LOI she signed in June 2021, she was surprised to learn that BCC wouldn’t be heading back to 343 Main. “We released our portion of South County rental property on May 31, 2022,” she wrote in an email. “We have an understanding to return when the space is renovated. We have not been contacted directly by Alander Construction as to a change in the scope of the project,” she wrote.

BCC’s executive director for workforce development, Deb Sarlin, told me in a phone call last month that she also had “no idea it was going to get converted into residential.” She said that since vacating 343 Main, BCC has utilized space across the street at St. James Place and held classes at Berkshire South Regional Community Center. She said BCC remains “fully committed to programming in South County.”

The community college will shortly open a new makerspace at its Pittsfield campus and is planning new and expanded collaborations in South Berkshire County. “There are some really interesting conversations to explore moving forward,” she said. Currently, BCC continues its free adult ESOL classes and other short community-education programming in South County, all while considering where to house these and other programs in the future. “Our continuing need for space in South County is real,” Sarlin told me in a recent email.

Across the board, BCC leadership is “really concerned about making sure that there’s a presence in [both] South County and North County that goes above and beyond Zoom calls,” she said.

As for the change in plans for 343 Main, she said, “It’s wonderful to have additional space for housing. That’s certainly needed. And it’s wonderful to have space for sufficient health-care services and walkable options for informal education. In the best of all possible worlds, all of that would be part of a thriving community.” In particular, Sarlin highlighted the need for housing that’s affordable for those with low and moderate incomes.

Gene Dellea, who as president of the board of the BCC Foundation negotiated the sale of the building to Rasch, said he wasn’t involved in recent discussions about BCC’s plans. “I don’t know. I haven’t been in [those] discussions,” he told me earlier this week. “I know originally our commitment was with Ian, which was that if the college was willing to stay there, would you be willing to honor that agreement? And he was.”

Dellea said said he couldn’t speak to what’s happened since. “The only thing I can say to my relationship with Ian, from a business standpoint, is that he was very honorable and he always stayed the course with us.”

Volunteers in Medicine (VIM), the 20-year-old nonprofit that provides free medical, dental, and other human services for under-served residents, planned to relocate to 343 Main and nearly double its footprint. Its letter of intent with Alander Group suggested it would pay $180,000 a year in rent, or $15,000 per month. That’s more than twice its current rental expense of around $7,000 per month, according to VIM’s board president, Arthur Peisner. (Rasch has been a VIM board member for several years.)

When I asked Ilana Steinhauer, a nurse practitioner and VIM’s executive director since September 2017, about it, she told me she wasn’t familiar with the details of the LOI, which was signed by Peisner. “I’ve never seen a $15,000 signed letter of intent,” she said in a phone call last month. Still, she said VIM decided sometime around January of this year to withdraw from a future tenancy at 343 Main because of rising costs and, importantly, where the organization’s changing clientele lives—largely an impact of the local housing crisis.

“Our new patients primarily used to be from South County,” she said. “It’s completely shifted over the past few years.” She said about 90 percent of VIM’s new patients now live in Pittsfield, where the organization doesn’t currently have any facilities. Some patients still work in South County, however. Steinhauer said there are ongoing board-level discussions about plans for new facilities with announcements expected soon.

“As nonprofits and as businesses in general, this is about balancing our operating costs,” she said. “Our biggest vulnerability is staffing, and so we need to make sure that our staff are paid so that they can live and thrive in the Berkshires. So we always have to balance that with what our overhead costs look like.”

Peisner, a longtime board member who has played a vital, two-decade-long role in the health nonprofit’s growth, told me that VIM’s LOI was approved by the full board—with Rasch not participating.

He said that as the project moved forward, VIM realized the projected cost for both rent and a substantial build-out of the new space became too expensive. “The renovation costs [and] the potential rental cost all went way out of what we had been projecting,” he told me. He said Rasch’s expenses for the project were increasing and that “the potential rent that [Rasch] would have to charge in order to eventually earn back his investment” became too much for VIM to afford.

Another healthcare organization, CHP Dental, had occupied a portion of the lower level of the building next to Jill Schwartz’s Elements jewelry studio since 2008 until it vacated in advance of construction this summer. While CHP initially planned to continue in roughly the same amount of space in the renovated building, over time its plans expanded substantially to, at one point, possibly leasing nearly the entire building, according to architectural plans presented by Alander at a Planning Board site-plan review in April.

Those plans showed CHP occupying 19,000 square feet of the 22,000-square-foot building, including the entire lower level. (A site-plan review is largely unconcerned with plans inside the building, though the building’s use is linked to external features like parking requirements.)

Rick Gregg, a CHP board member since 2016 who stepped in as interim CEO after the sudden departure of Lia Spiliotes in late June, told me that CHP provides a range of family health services for patients covered by Medicare, Medicaid (called MassHealth in Massachusetts), and those who have commercial insurance. He described “a huge unmet need” for dental services in southern Berkshire County. “We know that. It’s already documented. And if other dentists retire and are not replaced, the problem is only going to get worse,” he said.

He said while CHP hoped to stay at 343 Main, it didn’t come together. “We were just not able to work out the details. So no fault involved,” he told me. “This is simply trying to find a place that works at a price you can afford.” Other than what he described as “short-term dislocation,” he said things worked out fine. “I think we will be better off. And as a landlord, [Rasch] will be better off because he’ll get to renovate the whole building into whatever he wants it to be.”

This summer, as Rasch prepared to begin construction, CHP’s South County dental staff and patients shifted north to its Pittsfield facility. But aware of transportation challenges and coming winter weather, Gregg said CHP hopes to have dental services available soon at its Stockbridge Road health center located just north of the Price Chopper shopping plaza. “We’re in the process of developing both short-term plans and longer-term plans to have a much larger presence for CHP Dental in Great Barrington,” Gregg told me.

On the departure of two health-care nonprofits—and loss of perhaps a quarter-million dollars in annual rent—from the proposed health-and-wellness center, Rasch said in an email, “We spent a tremendous amount of time and energy working towards this goal with both Volunteers in Medicine and Community Health Programs. CHP, like many community health organizations, has experienced significant financial pressures with rising costs and shrinking reimbursement rates.”

He said he offered CHP a rate of $15 per square foot, which he said was lower than what it paid previously in the building, but that ultimately CHP decided to scale back its plans. (That rental rate is substantially lower than market rent for renovated commercial space in downtown Great Barrington, and about half of what Rasch’s market study suggested commercial rents could be in the Mahaiwe Block.)

Gregg said discussions about how much space CHP would lease and at what price predate his late-June hiring as interim CEO, though presumably the evolving plans were discussed at the board level. Still, he declined to comment on what he described in an email as “CHP’s prior private business negotiations about 343 Main.” He told me that CHP is in negotiations for new Great Barrington space where it hopes to build a “state-of-the-art” dental facility. “It’s a big deal,” he said. “We’re hoping to have 12 chairs. This is going to be a significant expansion.”

One of the more surprising conversations took place when I called Michael Leary, Berkshire Health Systems’ (BHS) director of media relations, to ask about BHS’ plans to occupy one of the two retail spaces in the refurbished 343 Main.

BHS has a significant relationship with Rasch. The county’s largest health-care provider leases both 10 Maple Street for Fairview Rehabilitation and other BHS medical facilities, and 780 South Main Street (a.k.a. East Mountain Medical) from Alander. BHS also has an apothecary—a pharmacy with an old-style look and name—in Williamstown.

In Rasch’s CPA application, he wrote that BHS planned to “leverag[e] the success of their Williamstown location to open a second location for their Berkshire Community Pharmacy.”

That was news to Leary. “There are no plans,” he told me earlier this month. “They talked about it pre-COVID but it has not been talked about in years.”

In a subsequent phone call, I asked Leary specifically about the June 2021 LOI signed by Anthony Rinaldi, BHS’s executive vice president. Leary would offer no additional explanation or details. “As I had mentioned earlier, at this time we have no intention of opening a retail pharmacy in Great Barrington,” he said.

BHS is a large, county-wide organization, so it’s possible that its various right hands don’t always know what its many left hands are doing. Rasch would only tell me that he “continues to have discussions with Berkshire Health Systems about it … no one’s signed any documents or completed any plans or specs yet.”

Ultimately, he said what ends up in the building’s two retail storefronts will be different than what was anticipated. “By the time we’re done with construction a year and a half from now, who knows where any of these [potential] tenants are organizationally and what they’re looking at from a strategic planning perspective,” he said.

And the planned “Sustainable Food Lab Berkshires,” presented as the marquee vocational-education tenant and featured prominently in the project narrative? It still doesn’t exist nearly a year-and-a-half after it provided a letter of intent to rent storefront space at 343 Main.

That June 2021 LOI was signed by David Curtis, a Stockbridge resident and former banker who serves on the board of economic-development group 1Berkshire and whose LinkedIn profile describes various ventures supporting and mentoring entrepreneurs here and on Cape Cod. The letter called for Sustainable Food Lab Berkshires to occupy 4,500 square feet for $9,000 per month, or $108,000 per year. It was signed by Curtis as the “President of Board, Sustainable Food Lab.”

When I called Curtis last month to find out where his organization would locate now that 343 Main is not available, he said he doesn’t head the board. “We don’t have any board and we don’t have a board chair. I’m just shepherding the process at the moment,” he told me. When asked where that process was, he said, “At the moment, nowhere. I’m really not interested in having a conversation about it.”

It’s not unprecedented or unusual to have a still-forming organization keep plans close to the vest. But Rasch’s project relied on Sustainable Food Lab Berkshires for more than $100,000 in rent and made it central to his two grant applications.

So I asked Curtis who else was involved in the project. “We have people from the restaurant industry, from academic community, from the economic development community, from the education community and from the, shall we say, fundraising donor community. We’ve pretty broad representation in the group,” he told me. But he declined to name any of them. “Look, I’m just not interested in disclosing anything at the moment, okay?” he said. As for any plans for culinary training, he said, “Again, I have no comment. We are continuing to explore the project from a variety of perspectives, and nothing has been firmed up at this particular time.”

There is no entity registered with the Commonwealth called Sustainable Food Lab Berkshires or evidence of a filing for nonprofit status. The only references online are in Rasch’s CPA application, news accounts of his purchase of the building, and mention on the website of an Alander historical-restoration consultant.

This all seemed curious. When I asked Curtis if he was a private-equity investor in 343 Main Street, he said no. But he wouldn’t answer directly when asked if he was personally an investor in any Alander project: “My business is my business … I wouldn’t affirm or deny,” he said.

When I asked Rasch the same question, he said Curtis was not an investor in any of his projects. “No. That’s an unequivocal no,” he told me. Alander Group does not publicly disclose the names of its private-equity investors.

It turns out a key driver, and instigator, of Sustainable Food Lab Berkshires is Great Barrington’s Steve Picheny, who I called earlier this week to discuss his interest in affordable and workforce housing. When I told him about Curtis’ reticence to reveal details about the group and plans for 343 Main Street, and asked for more information, he said, with a laugh, “I can reveal it. I’m the one who started it.”

Picheny, who lives part of the year in Great Barrington and the rest in Florida, sold his Railroad Street property to Rasch and Sam Nickerson in 2016 for $1.8 million. That’s where he had opened and held court at Pearl’s, the restaurant that anchored the top of Railroad Street for 11 years, alongside the iconic Martin’s Restaurant, before the block was redeveloped by Rasch and Nickerson into the 47 Railroad mixed-use complex.

He told me that he’s an investor in 47 Railroad and also contributed private equity to Rasch and Nickerson’s unsuccessful Manville Place project, written about earlier in this series. And he’s clearly a Rasch fan. “Ian is one of the most honest, ethical, community-minded, caring individuals I have ever met,” Picheny told me. “He really is. He’s just a stand-up guy who really cares a lot about the Berkshires.”

Picheny said that after BCC abandoned plans for its own culinary-arts program in the BCC building, he picked up the idea with Curtis and others. He also said he helped to connect Rasch with BCC.

The college’s earlier in-house effort to design a culinary program is reflected in the 2019 renovation and engineering plans for the “South County Center, BCC” included, confusingly, in Rasch’s CPA application (and discussed in part four of this series). Gene Dellea, the longtime Fairview Hospital president who also serves as president of the board of the BCC Foundation, told me this week that BCC had indeed explored an expansive plan to renovate the building on its own for a culinary-training program but determined it to be cost-prohibitive. Soon after, BCC began discussions with Rasch about a sale.

Describing his interest in championing culinary education, Picheny talked economic development. “I mean, truly, if you take a look at South County, the only thing that we have to build on is a reputation, founded or unfounded, that we’re a farm-to-table culinary center,” he said. And that led to the Sustainable Food Lab Berkshires idea.

When I asked about Curtis’ signature on the June 2021 LOI as “President of Board,” he said, “We had no board, we just had a little informal group and raised a little money and did a feasibility study that found yes, it is feasible.” But he said as plans moved forward last year, a challenge emerged.

“I was going to start this farm-to-table culinary institute, and it was going to be located at the BCC building,” Picheny said. He worked last year with accomplished restaurateurs Mark Firth, of Prairie Whale, and Josh Irwin, of Cantina 229 and 47 Railroad’s MoonCloud (co-owned by Billy Paul), and they were preparing to kick off their first local classes. But then it ran into a familiar problem. “All of a sudden, [the restaurateurs] said, ‘Look, we’re in really bad shape. I mean, we can’t hire people. We can’t find people because they can’t find a place to live,” Picheny said, concisely summarizing the region’s immediate economic-development challenge

Picheny saw his proposal as an economic driver for South County, but he was being told that “if we don’t solve this housing issue, all is for naught,” he said. So he turned his attention learning about the workforce-housing challenge. Plans for the Sustainable Food Lab and a culinary-training program were shelved.

When I asked when it was clear that taking space in 343 Main wasn’t going to be happen, Picheny recalled that it was a year ago as he prepared to head to Florida for the winter.

“It was exactly a year ago, last October,” he said. “You know, I mean, it was a lot of commitment. And we weren’t ready to say we’re going to commit ourselves to $100,000 a year rent,” he said, referring to the June 2021 LOI calling for rent of $9,000 per month. “It was just way too premature [for us] and Ian needed an answer. Maybe next year I could make a commitment, but I couldn’t back then. And Ian had plans,” Picheny said.

He painted a compelling picture of what it might have looked like. “That was the whole plan for the building,” he said. “Picture those big picture windows on Main Street being kitchens, stainless-steel kitchens. And how great it would be, people driving into Great Barrington and seeing that. And that’s really what we wanted to do but the timing was off.”

Picheny’s description of that timing will no doubt raise concern that Rasch proceeded with a full CPA grant application last December, and then made a related presentation to the Community Preservation Committee (CPC) a few weeks later, for a concept built around an idea he already knew was not going forward at 343 Main. The same pitch was central to Alander’s application, filed six months later, for a half-million dollars in state funds from the Underutilized Property Program.

Given that the CPA grant of $250,000 represents less than five percent of 343 Main’s original $5.25 million project cost, it’s hard to imagine a clever plan to hoodwink the CPC and town voters with a very public bait-and-switch. But given the totality of information, at minimum it’s clear that Rasch’s CPA application was in places sloppy and inconsistent, its proposed tenants’ commitment to the project substantially overstated—in the case of the Sustainable Food Lab Berkshires, almost entirely misrepresented—and communication from Rasch about his evolving plans quite poor.

Indeed, Rasch told me via email that he doesn’t remember when he first alerted Town Manager Mark Pruhenski or Assistant Town Manager and Director of Planning and Community Development Chris Rembold about the project’s change to high-end apartments.

The building’s change-of-use to residential apartments was not formally presented to the town until a brief site-plan review in front of the Planning Board on October 13, when the discussion focused mostly on traffic patterns in the parking lot. Plans submitted to the board in advance of that review feature a total of 13 studio, one-bedroom, and two-bedroom apartments ranging in size from 696 to 1,387 square feet.

Earlier, on August 25, Alander submitted an application for the project’s first building permit. Signed by Alander Construction head Roman Montano, it covered the first $220,000 of internal demolition and external repair work. The architectural drawings attached to the permit application showed CHP Dental occupying most of the building, even though by that point it was no longer part of the project. The only narrative of the proposed project’s scope of work included in the application was from a May, 2021, civil-engineer’s letter that described the former plan for a food lab and health-and-wellness tenants. It described the building as business and mercantile, not residential. A permit to begin that phase of work was issued the next day by Building Commissioner Edwin May.

Grant needed municipal support

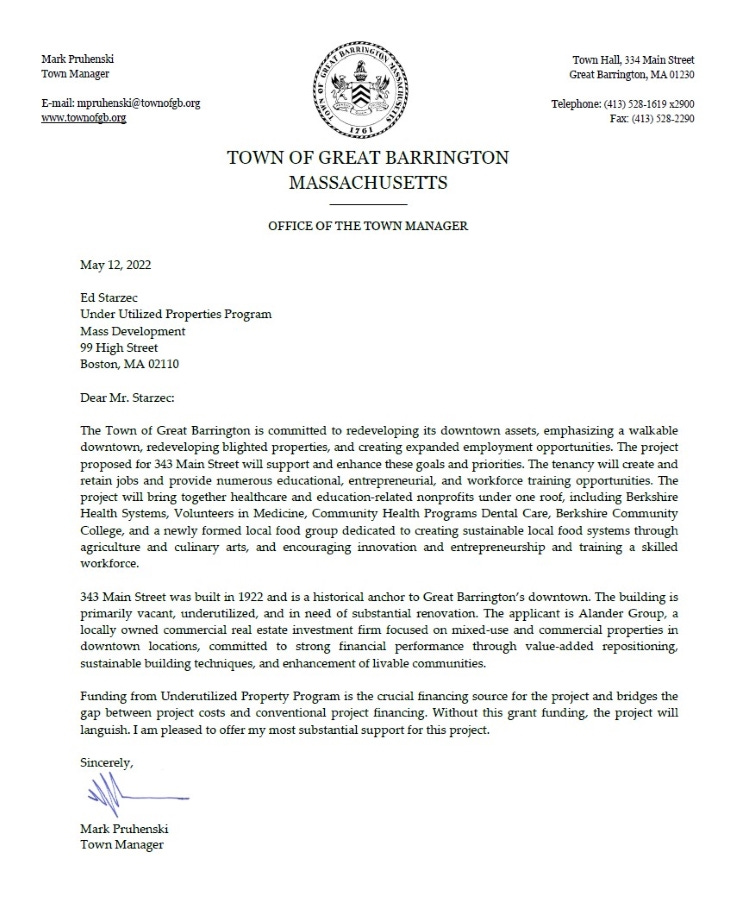

Winning the CPA grant from the CPC and then town voters was vital to the project, and not only because it was grant money as opposed to a loan that required repayment or investment capital that had to deliver a return. It would show crucial public support for Alander’s late-spring application for a second, larger grant: $500,000 from the state’s Underutilized Properties Program (UPP).

That program offers taxpayer-funded awards of up to $1,000,000 through a competitive grantmaking process that prioritizes projects with a public benefit, defined as, among other things “projects that will improve, rehabilitate or redevelop blighted, abandoned, vacated or underutilized properties” and that “increas[e] housing production and support economic-development projects.”

That can include market-rate housing as long as the project aligns with a town’s master plan and other local and regional goals. UPP grants can be made to for-profit developers like Alander, but the application instructions stress repeatedly, often in bold type, “For-profit entities will need to make clear the public purposes advanced by their proposed funding request.” And applications for UPP funds “must include a letter of support from the municipality clearly articulating the proposed funding’s public purpose/benefit.”

Rasch’s CPA application was clear about the connection. “Mass Development has encouraged Alander Group to apply in the June 2022 application round for UPP funds for 343 Main Street,” he wrote. “The application would benefit tremendously by being able to demonstrate local support in the form of CPA funding. UPP is a competitive program, and CPA funding would be a powerful leverage.”

That formal indication of municipal support came in a May 12, 2022 letter from Town Manager Mark Pruhenski. It featured similar language to that seen in support letters attached to both the CPA and UPP grant applications, noting the underutilized historic building and promoting the planned health, wellness, and vocational-training tenants. It promised a project that would “create and retain jobs and provide numerous educational, entrepreneurial, and workforce training opportunities.”

The letter also included a nod to UPP guidelines that require applicants to demonstrate financial need: “Without this grant funding, the project will languish,” Pruhenski wrote.

While these kinds of support letters are usually pro-forma and noncontroversial, the UPP requirement to show explicit support from a municipality is to ensure that public funds disbursed to private developers are spent in alignment with a town’s articulated needs. That’s why both the CPA grant and municipal letter of support were crucial.

Select Board chair Steve Bannon told me he wasn’t aware of Pruhenski’s letter. “I haven’t talked to Mark at all about this. Typically, Mark doesn’t do things like that without going in front of the board at a public meeting,” he said. “I’ve not heard of it. So if it happened, I didn’t know about it.”

When I asked Pruhenski about the letter, and also the subsequent change in use, he said in an email that his aim was “to support the re-development of an underutilized property.” He said he still supports the project with the change in use. “Creating housing is clearly a high priority for the town,” he wrote. “And if we can encourage housing creation and re-develop a prominent downtown property at the same time, it’s a win-win in my opinion.”

Pruhenski and Rasch both told me that the town did not submit an updated municipal-support letter reflecting the change in use to upscale market-rate apartments—with the possibility of a few reserved at lower rents—and how the new use aligns with the town’s pressing needs.

Among the documents provided in response to an Edge public-records request filed with MassDevelopment in early October was another letter of support submitted by Rep. Richard Neal, who represents the Berkshires and a large portion of western Massachusetts in Congress. It made specific mention of the CPA grant and how it was an indication of community support: “With the CPA Committee in Great Barrington voting to approve a $250,000 grant in January 2022, the town is committed to working with the Alander Group to make this project a reality,” Neal wrote. (Disclosure: I was a candidate in the 2012 Democratic congressional primary won by Neal.)

Rasch told me that he’s been in touch with MassDevelopment about the building’s change in use. “That’s not been an issue for them,” he said.

In the end, CPA and UPP funds for historic restoration and rehabilitating an underutilized property are, Rasch said, more accessible and far less onerous than applying for more traditional state and federal historic tax credits. Those can take years to secure in full and are better suited to larger projects, he said. Even then, he told me that many developers are lately opting out of pursuing them because of what he described as a long, bureaucratic, and complicated process. CPA and UPP grants are both awarded annually.

The problem of tenants

As reported in part four of this series, Rasch said his pivot to residential apartments was driven by factors including financial challenges faced by CHP and VIM, along with “market conditions.” It may also have been influenced by a previously unreported expense incurred to ensure he could renovate and lease, at the necessary rates, the entire building.

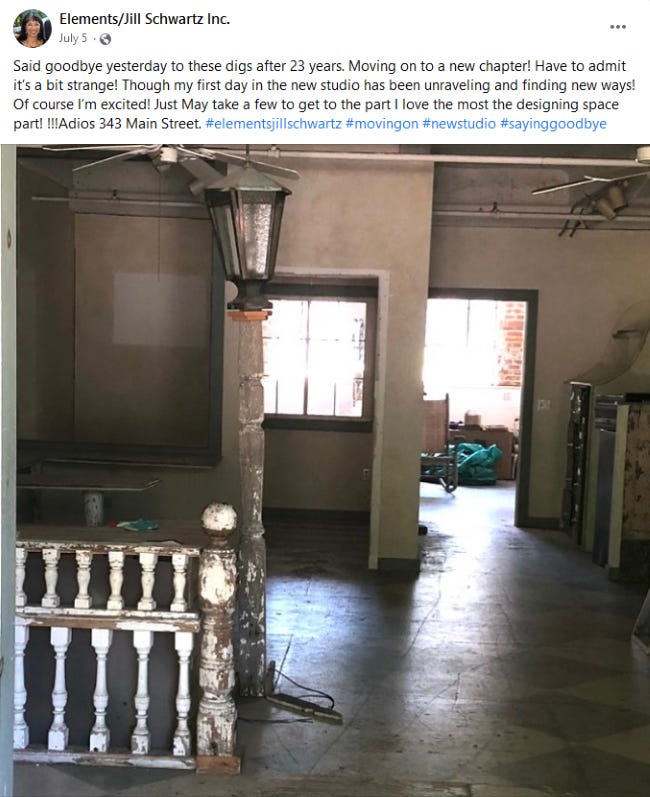

Elements, the jewelry-production studio and retail showroom founded by Mt. Washington designer Jill Schwartz, opened in its BCC building lower-level space in 1999. There were still three and a half years remaining on a long-term lease when Rasch acquired the property, and Schwartz’s tenancy, last December.

She didn’t want to move her business, which she started nearly 40 years ago in New York before relocating to the Berkshires. “It was a great space,” she told me this week. “It was like home. I didn’t want to leave it, and I told him I wasn’t going to leave it.”

Schwartz’s rent for the 6,000-square-foot space—nearly one-third of the rentable area of the building—was $1,650 per month, she said. That’s only $3.30 per square foot, a fraction of current market rents and far lower than what Rasch would need to make his financials work. (Proposed commercial rents for the renovated building disclosed in the CPA grant application ranged variously from $18 to $27 per square foot.)

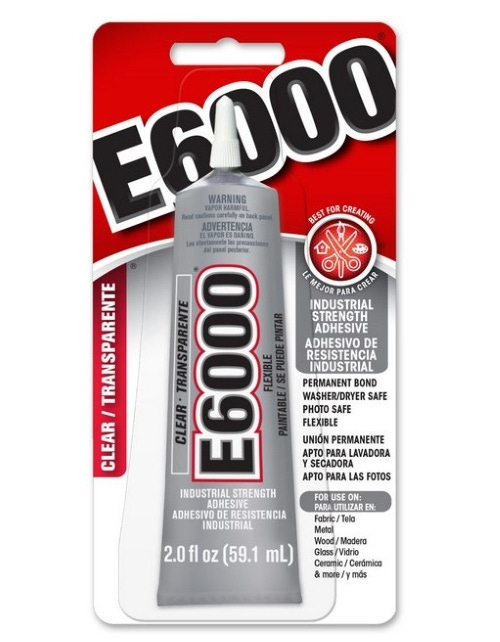

Because the sale hadn’t yet closed when Alander filed for a CPA grant, its application included the original purchase-and-sale agreement and several addendums that extended the due-diligence period and added other conditions. One of those addendums, signed March 16, 2021, called on the BCC Foundation to either require Elements to stop using a popular craft adhesive, E6000, or terminate the Elements lease. An eviction would solve Rasch’s tenant problem, and at no cost.

Concern about a chemical called tetracholoroethylene found in E6000, and elsewhere, was first raised during environmental investigations underway at the same time at the adjacent Carpenter’s Variety, the former gas station and now toxic brownfield site where a substantial amount of leaked petroleum from underground fuel tanks was first discovered in 1986. The discovery initiated more than two decades of environmental investigation and partial mitigation steps at Carpenter’s Variety and abutting properties.

That work was overseen by the Massachusetts Department of Environmental Protection (MassDEP), which funded monitoring and remediation efforts until 2012. MassDEP also attached liens to the property, owned by the former BCC building owner Isodore Goodman, in an attempt to recoup money spent by the state. (The town of Great Barrington is seeking to have the liens removed so it can take ownership of the property. It hopes to secure funds for additional remediation and then sell the property. Rasch told me he’s interested.)

In 2018 the town received a $300,000 EPA grant, administered by the Berkshire Regional Planning Commission (BRPC), to do brownfields assessments at that location as well as the polluted Reid Cleaners site further north on Main Street and at Cooks Garage in Housatonic. (Rasch serves on BRPC’s Berkshire Comprehensive Economic Development Strategy Committee.)

TRC, a global environmental consulting firm with an office in Lowell, Mass., did work under the grant that included evaluating monitoring wells installed decades ago at the Carpenter’s Variety brownfield and also nearby at the Searles Castle property, where petroleum had traveled in groundwater, and in two locations directly adjacent to the BCC building.

After TRC’s early work discovered petroleum in groundwater “above the state’s cleanup standard” in the two monitoring wells closest to BCC, the consultants performed additional indoor-air sampling and sub-slab soil-gas testing at the BCC building. The air-quality tests found elevated levels of tetrachloroethylene, or PCE, in all units, with the highest levels inside the Elements studio. There were also elevated levels of a second compound, 1,2-dichlorethane, in all indoor-air-tested locations on both floors, at substantially higher levels than the recommended maximum for residential use. (All tests focused on the higher limits allowed in commercial settings, but residential limits were also noted.)

That second compound is a probable carcinogen found in gasoline and oil, lubricants, tobacco smoke, and elsewhere. It’s also added to leaded gasoline to reduce engine wear, as a degreaser, and in dry-cleaning solvents. The chemical is also used to make vinyl chloride found in PVC pipes, automobile parts, and many consumer products.

PCE, also known as PERC, is found in many products including dry-cleaning fluid, degreasers, brake cleaners—and in the E6000 craft cement used by Elements. According to a draft copy of TRC’s report to the town and provided to me by BRPC, it’s not a chemical they expected to find while investigating contamination stemming from a petroleum leak into the ground. And the level found in Elements was much higher than what was found in the other locations tested.

In a series of emails and letters beginning in August, 2020, BCC alerted Elements to the test results. “I am emailing today to inform you of the results from the Air Testing that was conducted in your space in June,” wrote Shela Levante, then director of development at BCC. (Disclosure: I was a colleague of Levante’s during my work as a technology consultant for Berkshire Taconic Community Foundation from 2013 to 2017.)

This initial email noted that the focus of the investigation was “evaluating if a vapor intrusion pathway is present in your space from beneath the floor of the building.” It said there were indoor air concentrations of tetrachloroethylene and 1,2-dichlorethane that exceeded MassDEP’s commercial indoor air threshold.

Notably, the email continued, in bold red type, “At this time there are no health or safety concerns that would hinder your ability to operate in your space.” Somehow, it seems, those concerns changed as BCC continued its negotiations with Rasch.

Levante requested an inventory of any chemicals and cleaning supplies used in the Elements space, which was also requested from CHP Dental next door. That inventory led to the environmental consultant’s determination that the likely cause of elevated levels of PCE was the E6000 adhesive used by Elements.

The TRC report noted, “The indoor air sample from Elements exhibited the highest concentration of 229 ug/m3 of PCE above the commercial indoor-air threshold value (IATV) of 4.1 ug/m3 for PCE. PCE was also identified in all the other indoor air samples collected in the BCC building ranging from 6.92 ug/m3 to 167 ug/m3 above the commercial IATV for PCE.” In other words, some amount of the chemical was found throughout the building, not just in the Elements space. The conclusion was that the E6000 glue was the cause.

In a Zoom presentation hosted by the town of Great Barrington and attended by more than 200 people — including Rasch — in August, 2021, the TRC consultant working on the project, geologist and environmental consultant Tom Biolsi, said the amount of PCE in the indoor air would decline once use of E6000 stopped. “When that’s not used anymore, then the concentration is expected to decrease,” he said. By then, more than a year later, Elements had reduced its use of E6000 and was also using a different product without PCE, according to Schwartz.

Chris Rembold, the assistant town manager, concurred. “It’s not a persistent condition. Once that chemical is not used, no impact to the folks in that space,” he said. There was no discussion of any current or ongoing risk to anyone in the building at that time, which would not be vacated until the following summer.

Biolsi, who now works for environmental-consulting group Roux, also began working for Rasch about 18 months ago, according to both of them. That would have been roughly at the time the BCC Foundation was using TRC’s test results to move to evict Schwartz, and it also overlaps for roughly six months with Biolisi’s work for the town of Great Barrington under the EPA grant.

Biolsi told me this week that his work for the town and for Rasch were entirely separate, and funded separately, and that his work for Rasch is still ongoing at the site. Rasch and Biolsi both said the engagement was to complete typical real-estate due-diligence including what are known as Phase I and Phase II environmental site assessments. Biolsi told me that it’s not unusual to work for more than one client on overlapping projects at a single site. “It certainly happens. It’s not rare,” he said.

Regarding whether concentrations of PCE in the building have come down, as his analysis suggested it would once there was no longer E6000 in use in the building, he said that work is still to come. “We are working on doing the follow-up testing. It hasn’t been performed yet but we are planning to do that.” He said it will be the same regimen as what was done for the town to confirm that the results are going down.

One change, though, will be stricter requirements for residential use. In TRC’s summary report to the town, it noted that if other kinds of development other than industrial are contemplated for the Carpenter’s Variety site, and presumably the adjacent locations that currently show potential impacts, “Additional investigation, evaluation, and possibly remediation is warranted if a more sensitive use is desired (e.g., residential, day-care, playground).”

It was surprising to learn that additional testing to confirm the earlier supposition had not already been performed, given the importance of identifying and mitigating any potential environmental concerns associated with what will soon be a residential property.

Biolsi said that he expects the new testing will confirm the earlier results and analysis. “It’s not expected to be a problem,” he said, referring to the elevated levels of PCE from the earlier tests. “In the environmental field, it’s hard to say whether it’s going to be gone completely, but the goal is to be where it’s below the state’s threshold,” he said. “Where it’s not going to be posing a problem to inhabitants of the building, visitors of the building. That’s the goal.”

Biolsi explained that contaminants, if found in the soil or air under the building, can “pretty easily” be remediated much like radon is addressed with a sub-slab depressurization system that vents safely outside. He said that groundwater testing, like that done via the monitoring wells adjacent to the building, can help identify volatile organic compounds (VOCs) that might be a concern. “It’s a cautionary measure,” he said. “If you have some VOC-related contaminants within a certain lateral distance of a building, then indoor air evaluation should be conducted.”

Five months earlier, the results of Biolsi’s testing for the town of Great Barrington were used by Rasch and BCC.

On March 17, 2021, one day after signatures were placed on that contract addendum that called for BCC to address the issue or evict Elements, a Pittsfield attorney representing the BCC Foundation, Emil George, sent a certified letter to Schwartz. He declared her in default of her lease terms and wrote that BCC was terminating the lease “effective upon receipt of this letter.” It was, he wrote, based on BCC’s claim that Elements’ use of E6000 glue could mean “potential legal liability from its tenants and visitors to 343 Main Street.”

This was a very different message from BCC than what it told Schwartz eight months earlier, when the email from Levante emphasized, in bold and red type, that there was no danger from the elevated levels that BCC was now relying on to pursue eviction—an action that would help smooth the way for sale of the building to Rasch. Indeed, the June 2020 testing in advance of Levante’s first email showed levels of PCE in the unit far higher than the levels measured in February 2021 and used to justify the eviction.

Dellea, the BCC Foundation board president, said resolving the issue was important to the sale but also suggested it was a responsible course of action. “[Schwartz] was very determined that it wasn’t her issue. But we had to go by the consultant. We had no alternative.” Still, it’s clear the Elements space was a focus of negotiations with Rasch. “We had to take care of the problem, whatever it was, and that we had met the [environmental] requirements,” Dellea told me. “And [then] we were able to move forward with the [sale of] the building. Because it was also a problem for Ian,” he said. Those financing Rasch’s purchase, Dellea said, “wanted to make sure it was a clean building” without environmental issues.

Schwartz told me that the air-testing findings surprised her, not least because the amount of E6000 in use seemed to her to be relatively small. Her staff also used a “spray booth” connected to a fan and exhaust system when they worked with the glue. A duct directed the air pulled from the work area out a window on the north side of the building.

“This glue that I use, is 3.7 ounces with a maybe a half-inch diameter opening. And there were maybe two, sometimes three tubes are opened at a time,” she said. “But there was no way that that was creating what they were saying it was creating.”

However, she said that at a point in time she can’t place, and after months of requests to BCC a broken window on the north side of her studio where her spray-booth duct work exited was finally repaired. During the repair, the duct was pushed back into her space and the window closed. “So while it’s happening, the fan is not going anywhere because the window had been fixed incorrectly.”

Schwartz told me that because of the location of that window in the back of her large studio, in an area her staff called “the cave,” they didn’t know the exhaust system was no longer venting outside. But she couldn’t recall the precise timing of the window repair or her discovery of the problem and how it aligned with the ongoing air and sub-slab soil testing in the building.

She alerted BCC and the ductwork was eventually vented out through the external wall of the building. In the interim, she said, her staff sometimes worked outside with the adhesive when possible. They had also been using a different version of the glue, at least some of the time, that did not contain any PCE.

Ultimately, facing eviction after 22 years from a space she considered her second home, Schwartz retained her own environmental consultant. “He told me that they were using the wrong standards for measuring the air quality,” she said.

Her consultant produced a report suggesting, among other things, that testing and analysis procedures had been flawed and that arguments used by BCC’s attorney to suggest environmental “events of default” under her lease were inapplicable. Notably, when investigating air quality issues, Schwartz’s consultant noted that testing guidelines call for at least 48 hours without the use of any chemical in the area being tested—using the environmental-investigation term-of-art “confounding sources” — that might contribute to an inaccurate result. Schwartz said she followed that guidance and didn’t use E6000 inside during those pre-testing periods, when her staff worked outside when using the glue.

When I asked Biolsi about the claim in the consultant’s report, he told me that he hadn’t seen the report but that “the tests were performed in accordance with state procedures that we need to follow.” While there was a sampling error during the first testing of sub-slab soil gases in the Elements space in June, he said, subsequent tests were conducted without error or compromise. Later tests showed lower, but still elevated, levels of PCE in the air.

The TRC report noted that it did not identify anything else in or around the building “that could be considered a contributing factor.” To Schwartz and her consultant, that was a significant oversight, not least because the Elements space—and the entire building—was for many decades home to a succession of automobile sales and repair businesses where any number of products containing PCE were likely used. And across the parking lot was a building containing a longtime dry-cleaning business before it was torn down to build the Powerhouse Square and Berkshire Co-Op building a few years ago. At minimum, those should have been considered, they argued.

Soon after receiving the consultant’s report in May 2021, BCC backed off its efforts to evict. Dellea told me that he understood that the environmental issue had been resolved. “It wasn’t a problem anymore. It reached what they thought was a level beyond what was acceptable, and came down into the normal range,” he said. It’s unclear if he’s referring to additional testing done after February 2021, when TRC filed its draft report under the EPA grant.

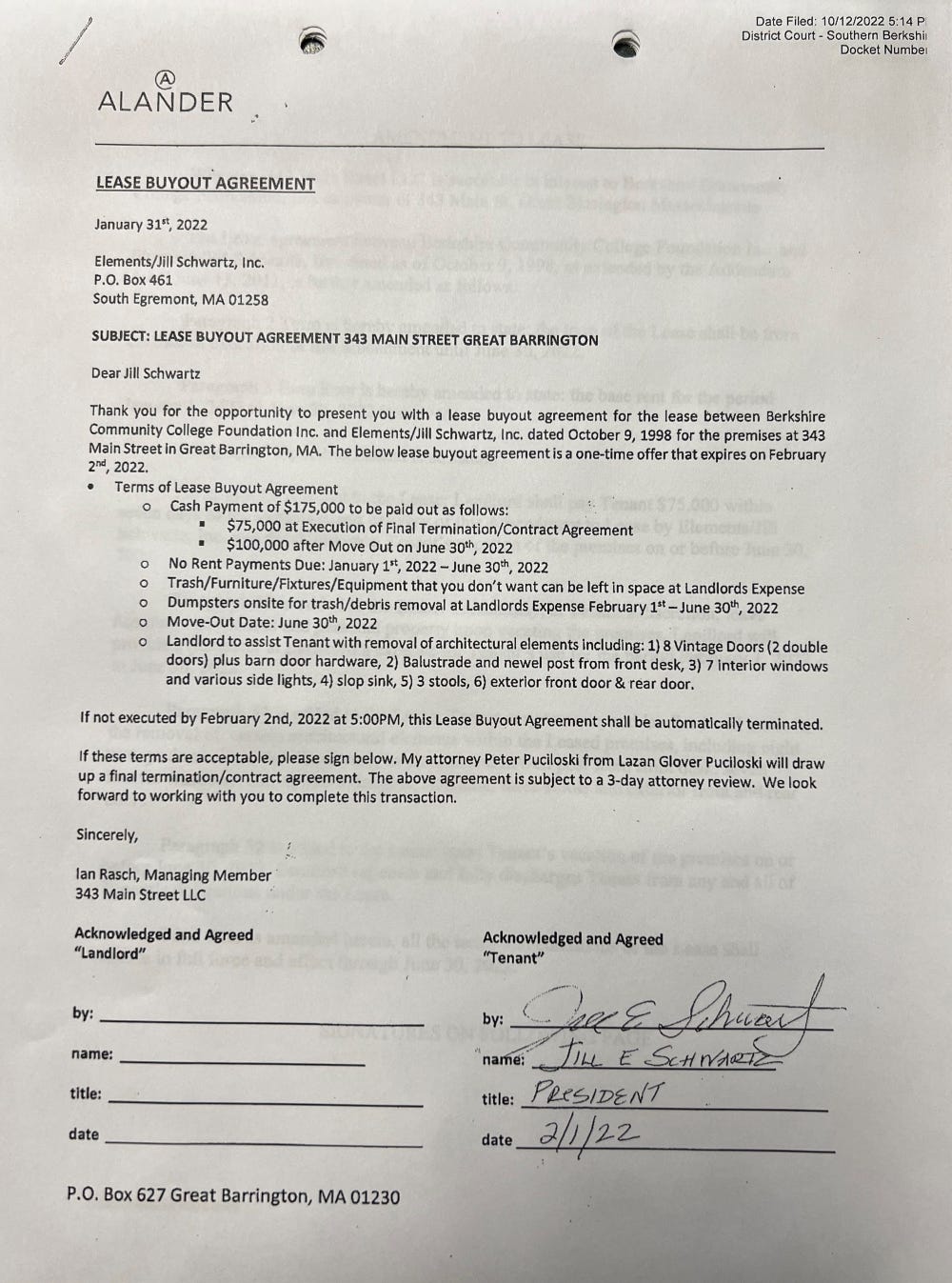

Shortly thereafter, Rasch and Schwartz began negotiations over the future of her tenancy. In July 2021, Rasch offered her $50,000 for a lease buyout, which she dismissed out of hand as insufficient to cover the expense of finding a new space, relocating, and the substantial cost of a build-out, she told me.

Over the course of the next seven months, Rasch continued discussions with BCC that led to the December 2021 transaction; acquired letters of intent from tenants; lined up investors and bank financing, and continued discussions with Schwartz. Clearly, this was a conundrum for his plans. An earlier purchase-and-sale addendum advanced by BCC struck language in Rasch’s initial offer to require BCC to deliver a building “free from all occupants and tenants” and replaced it with the clause “subject to existing tenants and licensees,” which protected the Elements tenancy.

Last week, when I asked Rasch about tenants and occupancy during the sale of a building, he told me that he’d rarely seen a transaction that did not require a building free of tenants.

“I can tell you from a development perspective, what I did [at Mahaiwe Block] is pretty unusual,” he said. “Usually, people would require that the seller provide a vacant building and go through all the bullshit of dealing with you know, evictions or whatever you have to do, right. So that’s typical. I’ve never actually taken title to a building, including 47 [Railroad] with leases in place because you just don’t want to deal with the liabilities of that,” he said.

Rasch ultimately bought out the remainder of Schwartz’s lease in February 2022. He made a payment of $175,000, provided a six-month rent abatement, and committed to assistance “with removal of [a list of] architectural elements” from the space, all according to a copy of the agreement filed in South Berkshire District Court on October 13 as part of a small-claims action initiated by Schwartz. In the complaint, she alleges Rasch did not meet his contractual obligation to assist with removal of the architectural elements, worth approximately $10,000, most of which she believes were destroyed during demolition this summer.

Schwartz told me that as she prepared to vacate the space in June, she worked with an Alander employee to mark the items to be relocated by Rasch per their lease-buyout agreement. Then she didn’t hear anything. In September, she began e-mailing Rasch about the items. Eventually he replied, rejecting her claims and saying he was not responsible for anything left behind after the move-out date of June 30, and saying, “With all due respect, we’ve accommodated you and compensated you well beyond what was reasonable.”

Her reason for filing the action? “Stick to your agreement. That’s what you agreed to,” she told me.

In an emailed statement, Rasch said Schwartz’s claim is “frivolous and without merit.” The matter has been referred to mediation. If that’s unsuccessful, there will be a magistrate hearing on November 28 in Southern Berkshire District Court in Great Barrington.

“Overall, I’m lucky,” Schwartz told me last week, describing the challenge of navigating a move in mid-pandemic after 23 years in the same space. “I think in the end I did okay, although I only have one-third of the space that I did.” She purchased a new studio on South Main Street where Leisure Pools used to be—ironic, perhaps, in that Leisure Pools was, for a time, located in a storefront unit at 343 Main Street.

Schwartz told me that the experience brought home the substantial challenge for small business in this real-estate environment, with rising prices and rents and little availability. And despite a lease buy-out that helped her purchase a new space, she has concerns about Rasch’s plans. “The bottom line is, I just feel like he’s barreling over small businesses,” she said. “And people who—in the town—he’s forcing them out with no real regard except for his development.”

She found that Rasch’s engagement with her differed depending on whether he seemed to be getting what he wanted. “When he gets what he wants, no matter how, he’s all nice and everything,” she said. “When he doesn’t, it’s like, there’s no humanity. There’s no real understanding. He wanted me to go out of business. He’s like, ‘Well, you could just stop doing what you’re doing’ … I had a lease and that worked perfectly for me.”

Schwartz also put the $175,000 buyout into context, given the moment and what was required. “He thinks he gave me a lot of money, but really, it wasn’t an an easy thing. He’s interrupting my business,” she said. “In the midst of a pandemic, which had just totally changed [my business], and adjusting to that. And then he throws this thing at me.” She said she felt pressured as negotiations continued, as Rasch described his plans to “work around [her]” and “fill the parking lot” with construction equipment. “He wanted me out,” she said.

The expensive buy-out of the Elements lease came not long after Volunteers in Medicine and its promised $180,000 in annual rent had disappeared. Sustainable Food Lab didn’t exist. BCC seemed to have vanished — from his plans, at least. CHP Dental’s space in the building was evolving, possibly expanding, possibly disappearing, with its CEO about to depart. The possibility of a BHS pharmacy was unclear. So by the time of 343 Main’s initial Planning Board site-plan review in April, the only tenants shown on the plans were CHP Dental, occupying 19,000 square feet, and the proposed BHS apothecary in one of the storefronts.

This was well into the pandemic housing gold rush in Great Barrington, with prices for residential properties climbing quickly; inventory being converted to second-home and seasonal use; and, according to the town’s 2020 housing-needs study, a zero-vacancy rate for rentals of any kind in a “supply-constrained market.” Tenants were confronted with enormous rent increases—with some booted so properties could be sold in the inflated cash-offer-heavy market or turned into lucrative short-term rentals.

These factors—along with uncertainties about demand for commercial space during and after the pandemic—all point to the business logic and perhaps inevitability of Rasch’s move to high-end rentals. Indeed, commercial leases are generally long-term with a built-in annual “escalator,” or regular increase, that’s agreed to at the time a lease is executed. The 343 Main Street letters of intent suggested that tenants would enter 10-year leases with a three percent annual escalator.

Given that Rasch’s market rent for new tenants at 47 Railroad had increased by an average of 30 percent in just four years, according to his market study, and that he had a large waiting list, the change made good—perhaps extremely good—business sense. So while his suggestion during our conversations that a switch to housing from wellness and workforce training was a community-minded decision, it’s clear there were substantial financial reasons as well.

Great Barrington’s developer problem

If Rasch faces headwinds convincing members of the CPC that his historic-preservation grant for the project should stand, that resistance may be based on more than just the pivot to luxury apartments and concerns about when he knew his plans had changed. It may also be, at least in part, the result of Great Barrington’s recent record with other private developers. It’s been spotty at best.

Notable was the Select Board’s 2016 permitting of a promised 88-room upscale hotel at the site of the former Searles School on Bridge Street to a well-known Berkshires hotel development group. Public hearings focused on a range of issues, including preservation of the building’s historic façade, which the developers, Vijay and Chrystal Mahida, agreed to do. But in more than six years, little has happened beyond some initial environmental cleanup, more broken windows, graffiti, a small fire, and continued crumbling of the aging structure. The developers say the pandemic interrupted the start of work in 2020, and the Select Board last year granted a 10-year tax-increment financing (TIF) agreement that will reduces taxes on the property if the promised $15 million is invested. (The TIF runs with the property, should it be sold. The Select Board conducted its discussions about the TIF in an executive session.)

But the quintessential example of a developer embarrassing town leadership and taxpayers is surely the tale of the old firehouse on Castle Street. After construction of a new $9 million firehouse on State Road in 2010, the old one, architecturally interesting and more than 115 years old, sat empty. Bricks and roof tiles tumbled randomly and dangerously to the ground. There was little interest from potential purchasers. A 2005 engineering study that led to the decision to build the new fire station detailed substantial repair and restoration work that would be required to rehabilitate the structure.

Then, after a new request-for-proposals was issued by the town in late 2010, the Select Board spent more than three years negotiating with Thomas Borshoff, a Rochester, N.Y. banker who partnered with former Great Barrington attorney and community fixture Edwin G. McCormick and James Mercer of Housatonic Water Works, who is also a current member of the CPC. That group, known as 20 Castle Street, LLC, promised an adaptive reuse that was all about service. “The vision, mission and motivation inspired by this property lies within its rich history and the original purpose of the building to help and serve the community,” the proposal said.

In a negotiating coup for the ages, surely aided by Select Board fatigue and perhaps wishful thinking, Borshoff closed the deal in 2014 for just $50,000. It included an additional $250,000 commitment from the town for asbestos and other environmental remediation at the site—with the little-reported detail that the buyer could request more funds if cleanup expenses exceeded $300,000.

The town further agreed to temporarily rent office space in the firehouse from Borshoff for its building inspector and health departments at $2,500 per month, and to pay all insurance and utility costs for the building while a tenant. And as yet another redevelopment incentive, the town also signed a TIF that reduced the assessed value of the building for 10 years, limiting Borshoff’s tax liability.

Looking back—and even at the time—Borshoff, McCormick, and Mercer’s winning proposal for adaptive reuse seemed almost comically unworkable on its face. It promised to transform the firehouse into “ArtWorks,” a community space filled with a variety of culinary-related and career-training enterprises the trio said would have “a programmatic focus on education, vocational training, jobs, and career counseling.” Which certainly sounded compelling as the region emerged from the Great Recession. And while unrelated, it had at least a whiff of what was promised in Rasch’s “Sustainable Food Lab and Health and Wellness Center.”

Yet in the case of 20 Castle Street LLC, none of the proposed tenant organizations or projects existed, save the Great Barrington Historical Society, which was promised 2,500 square feet on the renovated building’s first floor. (Mercer is a longtime Historical Society board member.) Nor did anyone on the project team have any substantial experience in those areas. That seemed an obvious red flag. The promised use was paired with a commitment to invest more than $4 million in the property to make it happen, all of which seemed far-fetched at best.

Indeed, buried in the application narrative was this caveat: “At this stage, it is unclear if this Vision will be economically viable. For the building to be a true long-term asset to the community, it must be economically viable and capable of sustaining itself.” Loophole? Meet large truck.

Town officials seemed unwilling to consider that a promise to invest $4 million or more into a building filled primarily with wonderful-sounding-but-non-existent vocational-training nonprofits would, if it ever materialized, make positive cash flow and a developer’s profitable exit extremely unlikely. Absent, of course, the discovery of gold bars or a lost Da Vinci notebook behind some long-undisturbed masonry.

Perhaps predictably, Borshoff largely disappeared for much of the next six years, collecting $30,000 a year in rent for several years, unresponsive to town inquiries, and doing little work on the property. He finally sold it to Warrior Trading’s Ross Cameron for $423,000 in January 2020—with taxpayers still on the hook for unspent remediation funds. No vocational training or other services were ever provided. None of the new organizations promised in the application exist today.

Steve Bannon, who was Select Board vice chair at the time, said as the project languished in 2016, “[I have] complete confidence in Tom [Borshoff]. If he says he’s going to do something, he’ll do it. I think he’s still going to do what he’s promised us.”

When I spoke to Bannon about it in early October, he offered a thoughtful take on that experience and some new details into why he thinks the project ran off the rails.

“Tom was very open that he was not in this to make money, for reasons that I won’t disclose,” Bannon explained. “He really thought he owed the town something because they treated him and his family very well.”

He said that despite owning a lot of property in Rochester, Borshoff may have done inadequate due diligence. “Great Barrington isn’t Rochester,” he said. “When [Borshoff] started trying to hire people, contractors, and get materials, it wasn’t Rochester. Rochester was much cheaper, and he may not have either done his homework or been prepared for the sticker shock that was Great Barrington.”

“I continue to think that if you don’t take chances, reasonable chances, you’re never gonna get anywhere,” Bannon told me. “I like Tom Borschoff. I thought he was true to his word and it just didn’t work out for him for whatever reason. And if I had to do it all over again, in hindsight, I probably wouldn’t. But at the time, it seemed like the best project and it just didn’t work out.”

Still, showing the straightforwardness that has long made him a steady presence in town government, Bannon said he believed Borshoff’s proposal was sincere. “Most people would laugh at me for saying that, because it surely didn’t work out that way. And it was too bad. And I, you know, I haven’t talked to him in years. Whether he was sincere or not, I don’t know. But I always like to take people at their word till they prove otherwise. I guess maybe he’s proved otherwise. But I think at the beginning, he was sincere.”

The Underutilized Properties Program, to which Rasch applied for $500,000 in state funds, is expected to announce this year’s grant recipients within weeks.

And members of Great Barrington’s Community Preservation Committee will hear from Rasch regarding his project at 343 Main at their meeting on November 1. They may also review preliminary applications for CPA grants it will recommend to voters next year. Rasch said he intends to seek affordable-housing CPA funds in this grant cycle to help subsidize some of the high-end apartments he’s building in the “mixed-income downtown” he says we need to preserve.

NEXT: Rasch’s purchase of the Prospect Lake Park campground in Egremont has left its longtime seasonal campers, Egremont residents, and many others wondering what is planned for the historic lakeside property. In part six, the developer’s vision for a transformed, and very different, hospitality enterprise.

(This series first appeared in The Berkshire Edge.)